Broadening Wedge Pattern

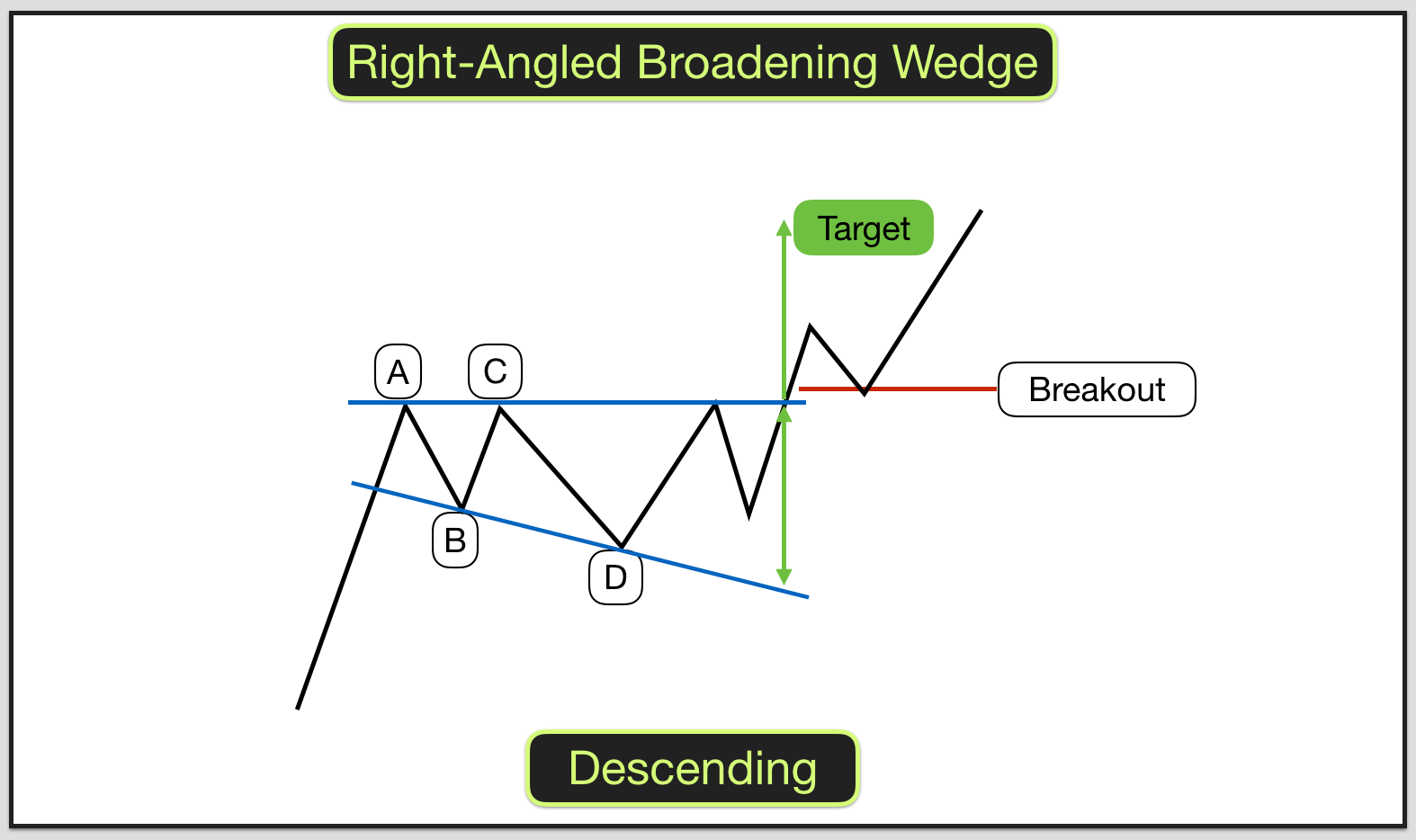

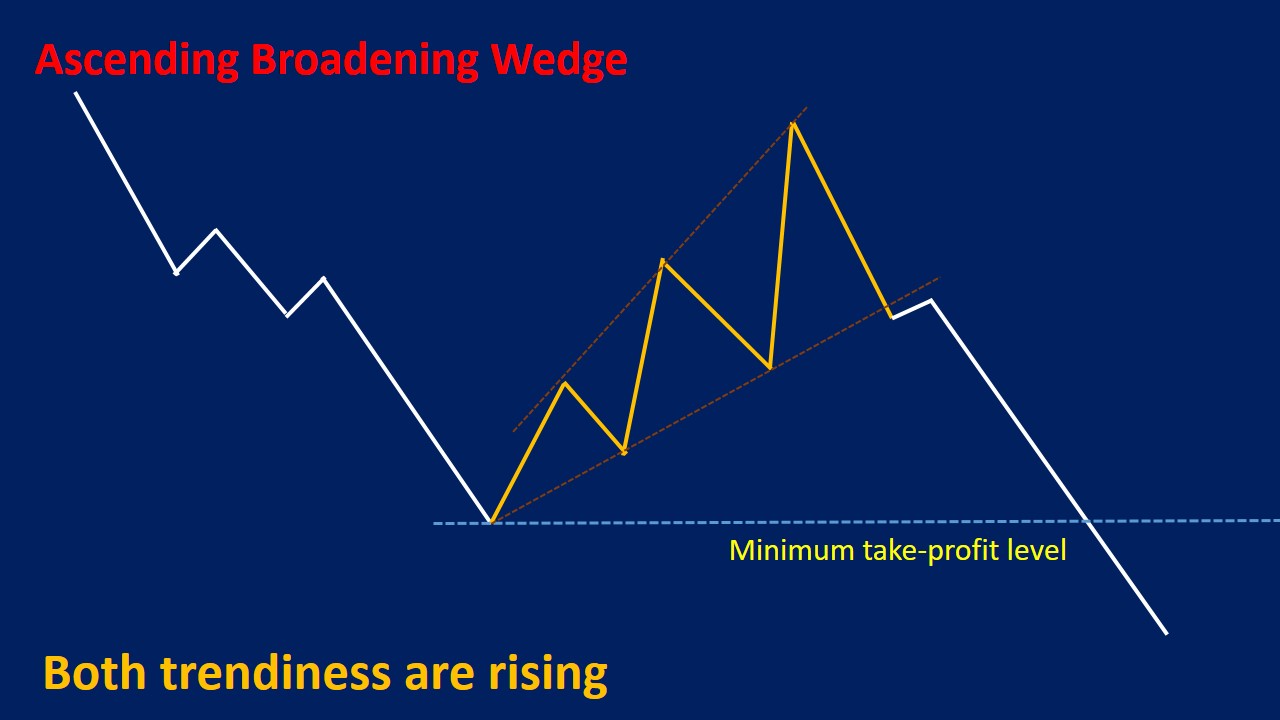

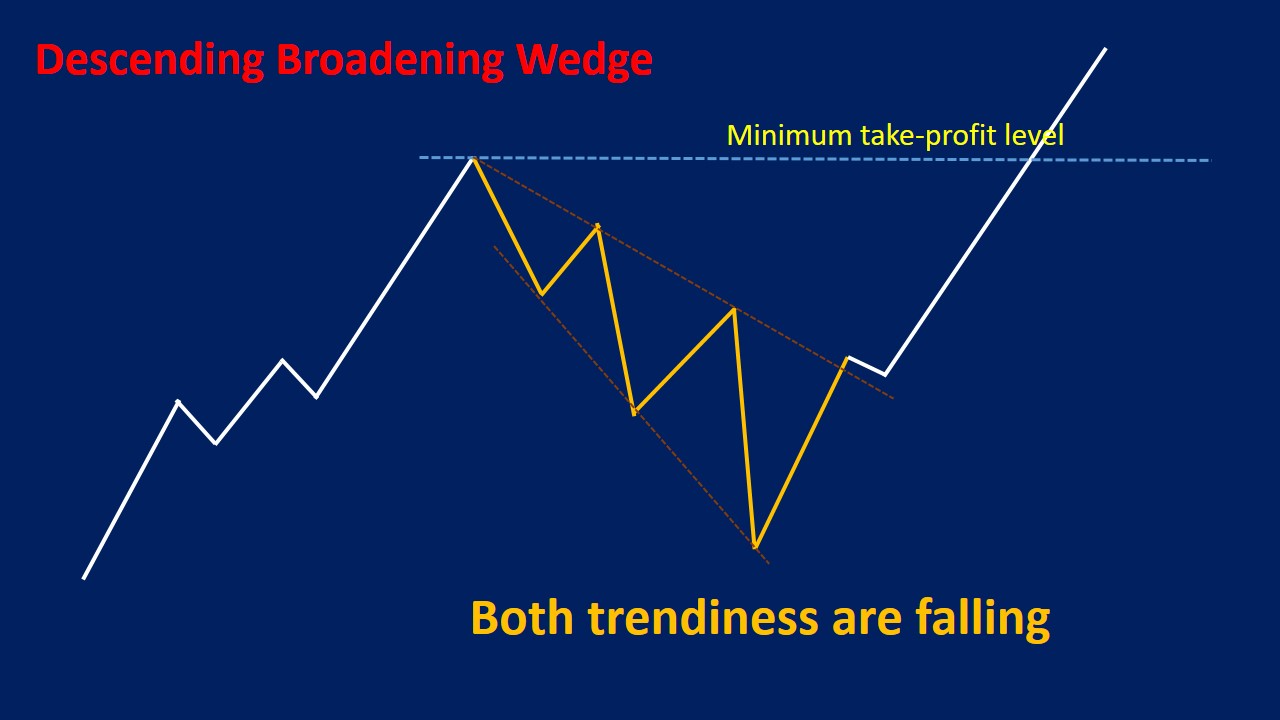

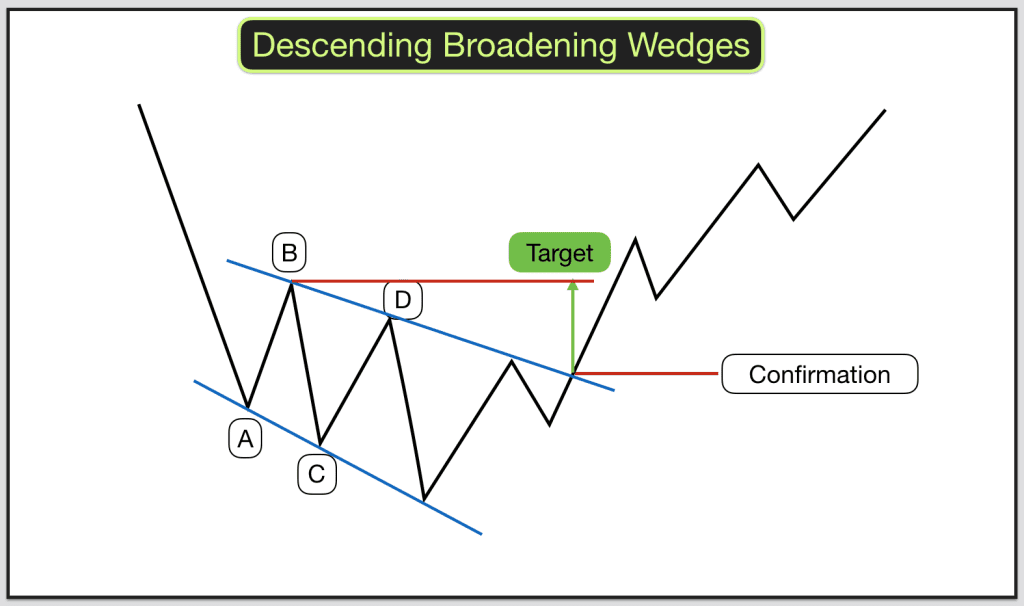

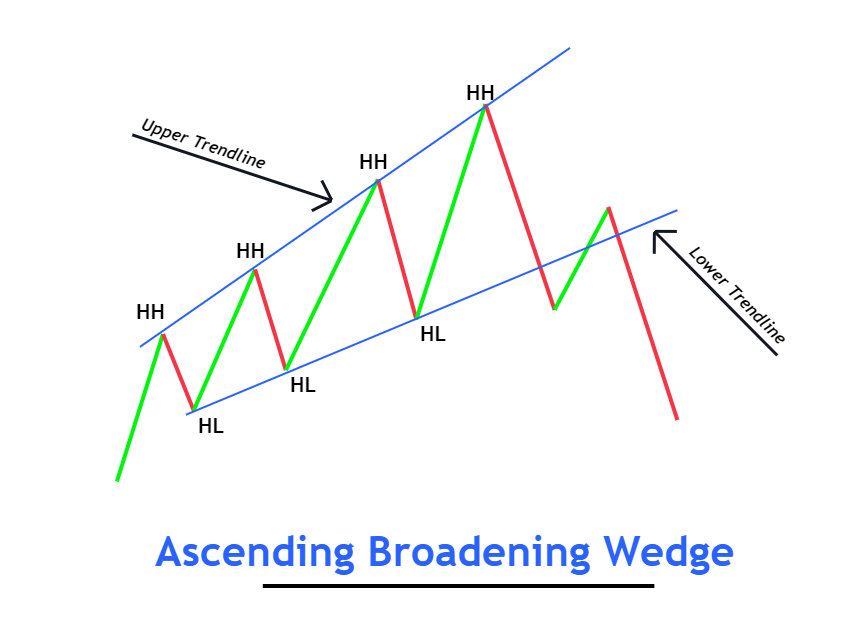

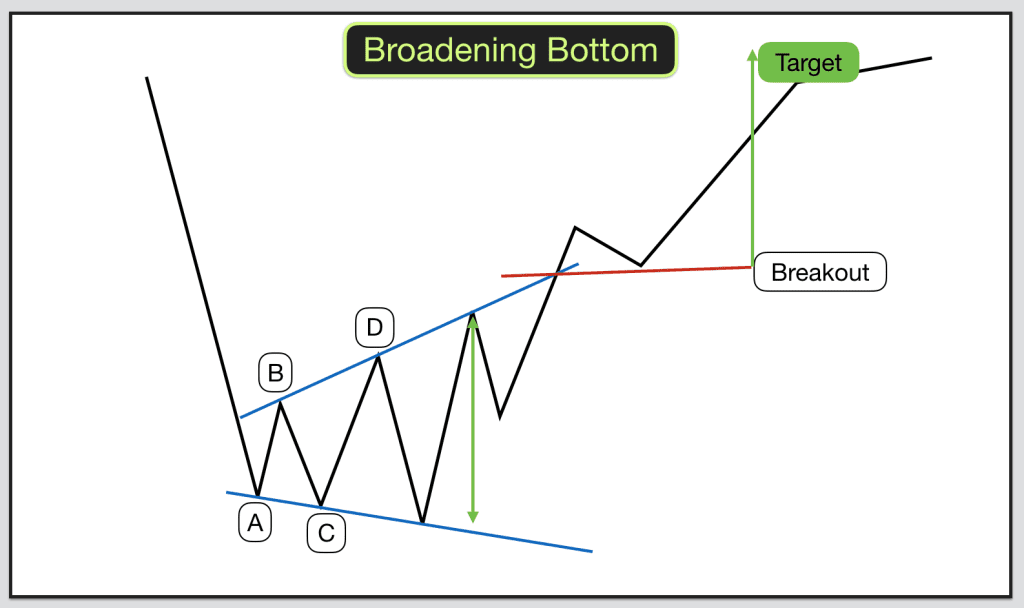

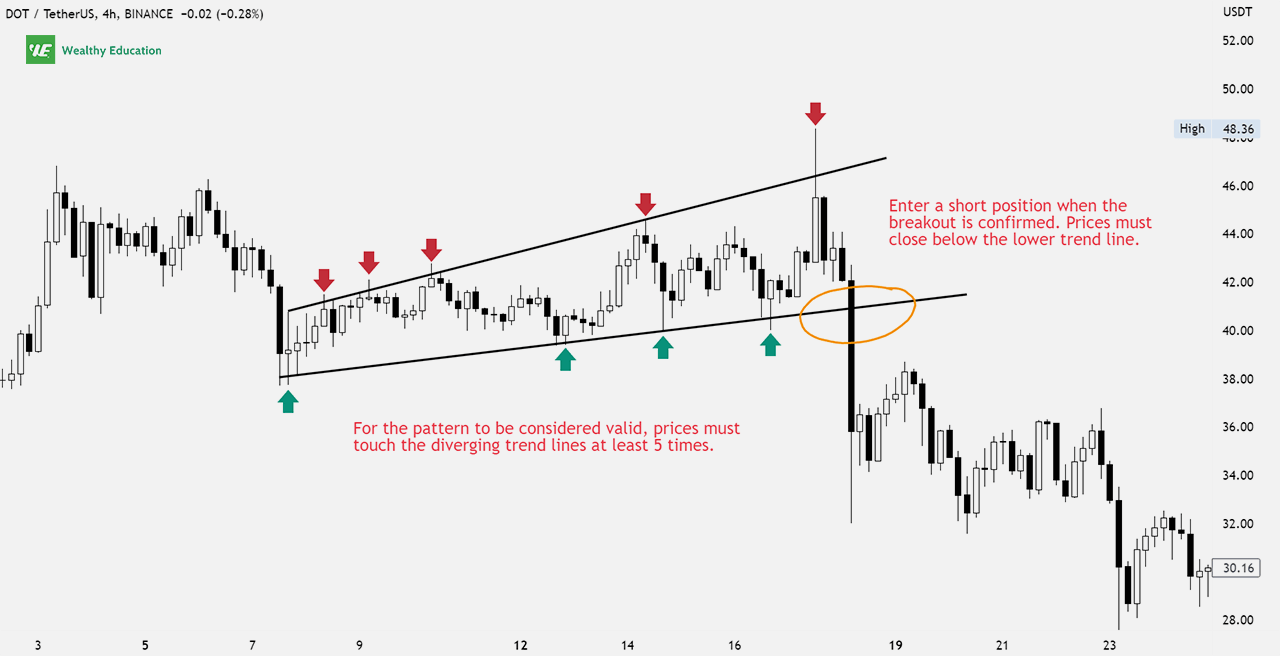

Broadening Wedge Pattern - Web the broadening wedge pattern is a chart pattern recognized in technical analysis, used by traders and analysts to predict the potential future price movements within a specific financial market. In other words, in a broadening wedge pattern, support and resistance lines diverge as the structure matures. If we compare broadening wedges, they are the flip side of regular wedges. Web there are 6 broadening wedge patterns that we can separately identify on our charts and each provide a good risk and reward potential trade setup when carefully selected and used alongside other components to a successful trading strategy. Web descending broadening wedge has the appearance of a bearish megaphone pattern. Web ascending broadening wedge: Web together, falling and rising wedges make up examples of bullish wedge patterns and bearish wedge chart patterns with contrasting meanings. Web a broadening formation is a price chart pattern identified by technical analysts. An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. We provide a description of each pattern and its implications. In other words, in a broadening wedge pattern, support and resistance lines diverge as the structure matures. Web the broadening wedge pattern, also known as the megaphone pattern or broadening formation, is an important chart pattern used by technical analysts to identify potential breakouts and. This pattern is characterized by two diverging trendlines sloping upwards, indicating an increasingly wider trading range over time. Web in a wedge chart pattern, two trend lines converge. When the broadening wedge is aligned horizontally, the price makes higher highs at the top and lower lows at the bottom. Most often, you'll find them in a bull market with a downward breakout. Web the broadening wedge pattern is a technical chart pattern characterized by diverging trend lines, forming a shape that resembles a widening wedge. It is characterized by increasing price volatility and diagrammed as two diverging trend lines, one rising. Read this article for performance statistics and trading tactics, written by internationally known author and trader thomas bulkowski. In most cases, this pattern results in a strong bullish breakout. The entry (buy order) is placed when the price breaks above the top side of the wedge, or when the price finds support at the upper trend line, the entry (buy order) is placed. Most often, you'll find them in a bull market with a downward breakout. This pattern can appear in both uptrends and downtrends and is used by. It is characterized by increasing price volatility and diagrammed as two diverging trend lines, one rising. Most often, you'll find them in a bull market with a downward breakout. In most cases, this pattern results in a strong bullish breakout. Learn entries, exits and even measured objectives. Expanding wedge and broadening wedge pattern. Web want to know how to trade the broadening wedge pattern for consistent profits? It is characterized by increasing price volatility and diagrammed as two diverging trend lines, one rising. The ascending broadening wedge is a chart pattern that tends to disappear in a bear market. It is created by drawing two diverging trend lines that connect a series of. Web a broadening wedge pattern is a price chart formations that widen as they develop. Web the broadening wedge pattern is a technical chart pattern characterized by diverging trend lines, forming a shape that resembles a widening wedge. If we compare broadening wedges, they are the flip side of regular wedges. Web the broadening wedge is a chart pattern that. It is created by drawing two diverging trend lines that connect a series of price peaks and troughs. The upper trend line of an ascending broadening wedge goes upward at a higher rate than the lower one, thus creating an apparent broadening appearance. When the broadening wedge is aligned horizontally, the price makes higher highs at the top and lower. Web the broadening wedge pattern is a chart pattern recognized in technical analysis, used by traders and analysts to predict the potential future price movements within a specific financial market. It is formed by two diverging bullish lines. Web a broadening formation is a price chart pattern identified by technical analysts. Web decending broadening wedges are megaphone shaped chart patterns. It is characterized by increasing price volatility and diagrammed as two diverging trend lines, one rising. Web a broadening wedge pattern is a price chart formations that widen as they develop. Web in a wedge chart pattern, two trend lines converge. Web a broadening formation is a price chart pattern identified by technical analysts. Wedges signal a pause in the. Web decending broadening wedges are megaphone shaped chart patterns with lower peaks and lower valleys. The upper trend line of an ascending broadening wedge goes upward at a higher rate than the lower one, thus creating an apparent broadening appearance. An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. Know about ascending broadening. It is represented by two lines, one ascending and one descending, that diverge from each other. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. It is formed by two diverging bullish lines. Expanding wedge and broadening wedge pattern. Web the ascending broadening wedge pattern is a. Web the broadening wedge pattern is a chart pattern recognized in technical analysis, used by traders and analysts to predict the potential future price movements within a specific financial market. Beyond slope direction as a key classifier, there are also pattern varieties based on volatility behavior. This pattern is characterized by increasing price volatility, and it’s diagrammed as two diverging. Know about ascending broadening wedge pattern that signifies market volatility, wherebuyers try to stay in control, and sellers try to take control of the market. Web the broadening wedge pattern is a technical chart pattern characterized by diverging trend lines, forming a shape that resembles a widening wedge. This pattern is considered a reversal pattern, as it typically indicates that the price is losing momentum and that a trend reversal may be imminent. Web the broadening wedge is a chart pattern that is formed when the price of an asset moves within two diverging trendlines, resembling a widening triangle or wedge shape. We also review the literature in order to find their deterministic cause. Web the ascending broadening wedge pattern is a significant chart pattern in technical analysis, recognized for its distinctive structure and bearish implications. Web the broadening wedge pattern is a chart pattern recognized in technical analysis, used by traders and analysts to predict the potential future price movements within a specific financial market. The upper trend line of an ascending broadening wedge goes upward at a higher rate than the lower one, thus creating an apparent broadening appearance. It means that the magnitude of price movement within the wedge pattern is decreasing. Web while symmetrical broadening formations have a price pattern that revolves about a horizontal price axis, the ascending broadening wedge differs from a rising wedge as the axis rises. We provide a description of each pattern and its implications. This pattern can appear in both uptrends and downtrends and is used by traders to signal potential bullish or bearish price movements. The ascending broadening wedge is a chart pattern that tends to disappear in a bear market. Web a broadening wedge pattern is a price chart formations that widen as they develop. This guide has it all. It is created by drawing two diverging trend lines that connect a series of price peaks and troughs.How to trade Wedges Broadening Wedges and Broadening Patterns

How to trade Wedges Broadening Wedges and Broadening Patterns

Broadening Wedge Pattern Types, Strategies & Examples

Broadening Wedge Pattern Types, Strategies & Examples

How to trade Wedges Broadening Wedges and Broadening Patterns

Ascending Broadening Wedge Definition ForexBee

How to trade Wedges Broadening Wedges and Broadening Patterns

Broadening Wedge Pattern (Updated 2023)

Widening Wedge Chart Pattern

Trading The Broadening Wedge Your Start To Profit Guide

Web When There Is A Partial Rise, In 8 Out Of 10 Cases, The Result Is A Downward Breakout.

An Ascending Broadening Wedge Is Confirmed/Valid If It Has Good Oscillation Between The Two Upward Lines.

In Other Words, In A Broadening Wedge Pattern, Support And Resistance Lines Diverge As The Structure Matures.

Web First, As Shown Above, Bitcoin Has Formed A Falling Broadening Wedge Chart Pattern.

Related Post: