Bull Flag Pattern Vs Bear Flag

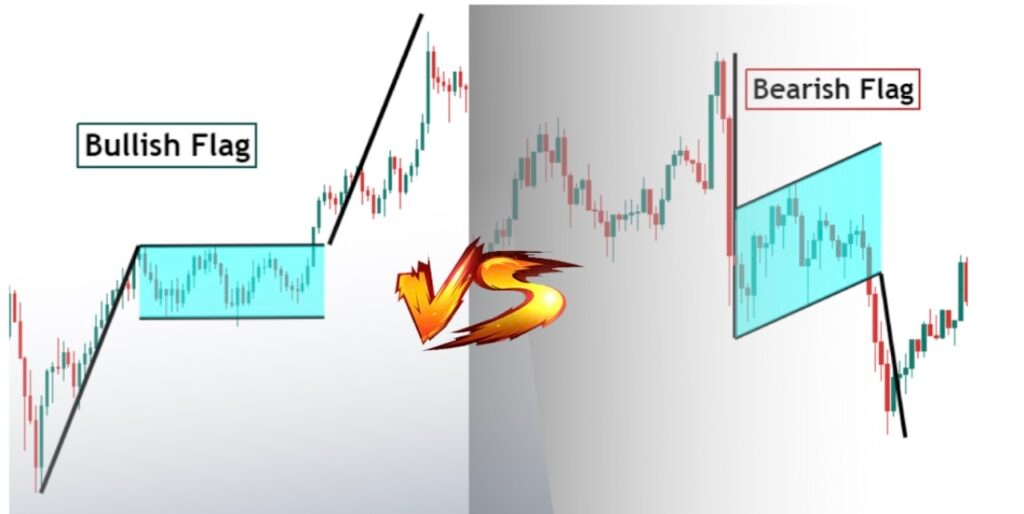

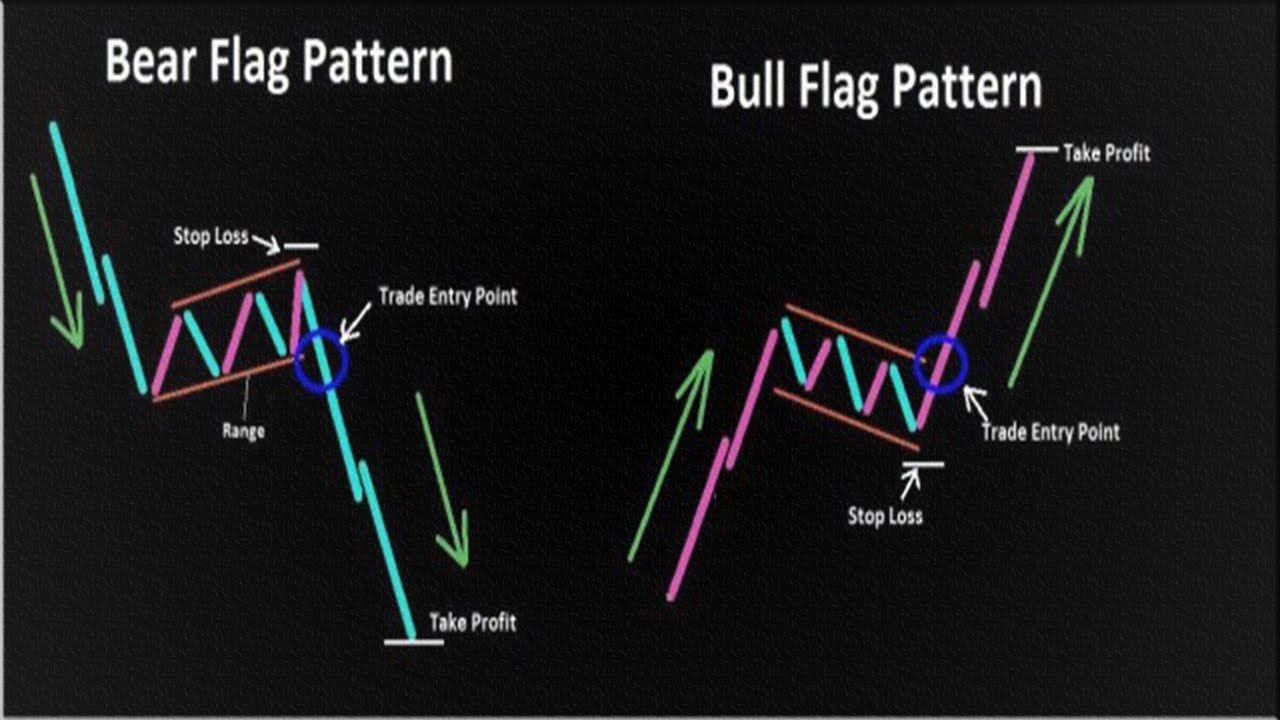

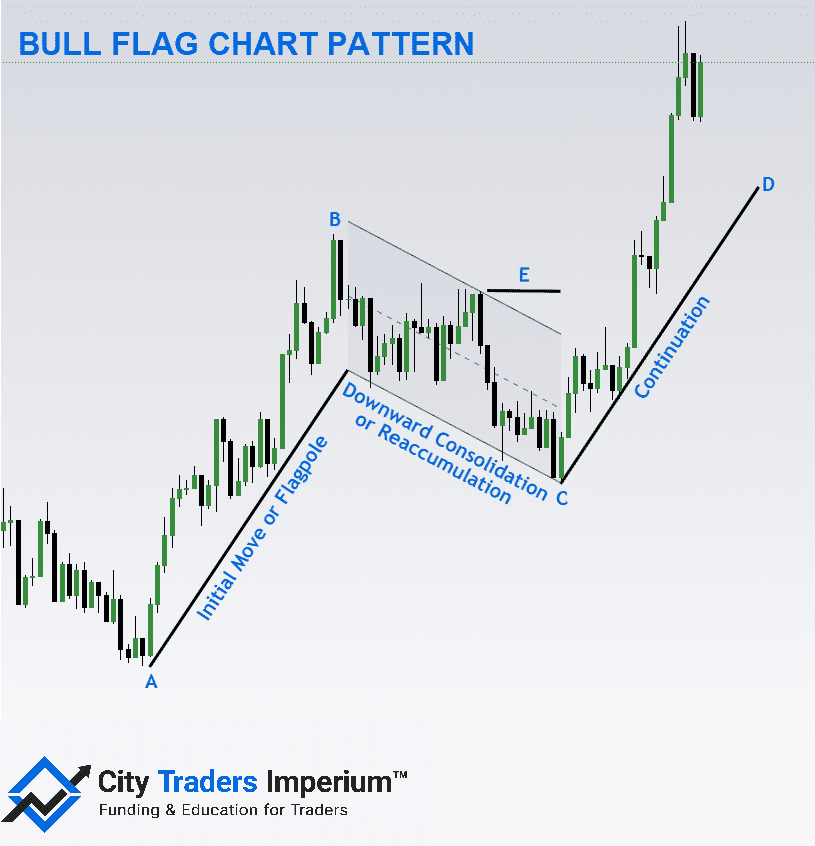

Bull Flag Pattern Vs Bear Flag - Every bull flag and bear flag pattern is characterized by six primary traits: Web the strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. Web a bull flag is appropriately spotted in an uptrend when the price is likely to continue upward, while the bear flag is conversely spotted in a downtrend when the. By learning how to identify and trade flags within the prevailing trend, traders can profit from. Web bear flag vs bull flag: It forms during a downtrend, starting with a sharp decline in price, followed by a consolidation phase. Bull flags and bear flags are price patterns. The “flagpole” is strongly bullish, with higher highs and higher lows; Bull flags and bear flags are continuation price chart patternsin technical analysis. Web bull flags indicate a potential trend continuation of an uptrend, providing an entry point for long trades, while bear flags may foreshadow a downward trend. By learning how to identify and trade flags within the prevailing trend, traders can profit from. What does a bull flag pattern look like? Bull flags and bear flags are continuation price chart patternsin technical analysis. The bullish flag pattern happens during an uptrend, and the bear flag pattern happens during a downtrend. Web bull flags indicate a potential trend continuation of an uptrend, providing an entry point for long trades, while bear flags may foreshadow a downward trend. Web key differences between bear and bull flags. Bull flags and bear flags are price patterns. Web the strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. Web both the bull flag and the bear flag slant against their respective trends — the bull flag against the uptrend and the bear flag against the downtrend — signaling a brief lull in. Web bull and bear flags are popular trend continuation patterns in technical analysis, but here, we will focus on the bear flag. Every bull flag and bear flag pattern is characterized by six primary traits: Web 10 min read. Web a bear flag pattern is the inverse of a bull flag pattern, characterized by an initial decline followed by a consolidation higher inside a parallel channel. When a bear flag unfurls, traders brace for action. Web a bull flag is appropriately spotted. It forms during a downtrend, starting with a sharp decline in price, followed by a consolidation phase. Web key differences between bear and bull flags. Fact checked by lucien bechard. The “flagpole” is strongly bullish, with higher highs and higher lows; Web a bear flag pattern is the bearish counterpart to the bull flag. Every bull flag and bear flag pattern is characterized by six primary traits: Web the strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. Web to be considered a bullish flag, this formation needs to have the following characteristics: How to trade flag patterns? Web. Web in this article we discuss the difference between bull flag vs bear flag, how to identify them, and how to trade them so you can have more consistent and profitable trades. Fact checked by lucien bechard. Web key differences between bear and bull flags. Web bull flag vs bear flag are powerful chart patterns for trading trend continuations. Web. Web the bull flag has a rectangular shape or a slight downward slope during the consolidation phase, while the bull pennant forms a triangular shape with converging. When a bear flag unfurls, traders brace for action. The bullish flag pattern happens during an uptrend, and the bear flag pattern happens during a downtrend. Web the strong directional move up is. What is the bear flag chart pattern. Bull flags and bear flags are price patterns. The retracement of the flag should not be higher than 50% compared to the flag pole. Every bull flag and bear flag pattern is characterized by six primary traits: Web bull flag vs bear flags: Web 10 min read. Web the strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. Web key differences between bear and bull flags. It forms during a downtrend, starting with a sharp decline in price, followed by a consolidation phase. The “flagpole” is strongly bullish,. Fact checked by lucien bechard. Web in this article we discuss the difference between bull flag vs bear flag, how to identify them, and how to trade them so you can have more consistent and profitable trades. Bull flags and bear flags are price patterns. Web a bull flag is appropriately spotted in an uptrend when the price is likely. What does a bull flag pattern look like? Web in this article we discuss the difference between bull flag vs bear flag, how to identify them, and how to trade them so you can have more consistent and profitable trades. Web the strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what. Web bull flag vs bear flags: Web the strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. Web 10 min read. Web bull flag vs bear flag, this guide will explain the difference between the two of the most popular patterns and how to trade. The area of consolidation in price action that follows and counters a preceding a sharp price movement. The “flagpole” is strongly bullish, with higher highs and higher lows; Web bull flags indicate a potential trend continuation of an uptrend, providing an entry point for long trades, while bear flags may foreshadow a downward trend. Web to be considered a bullish flag, this formation needs to have the following characteristics: Every bull flag and bear flag pattern is characterized by six primary traits: The bullish flag pattern happens during an uptrend, and the bear flag pattern happens during a downtrend. What is the bear flag chart pattern. Bull flags and bear flags are continuation price chart patternsin technical analysis. By learning how to identify and trade flags within the prevailing trend, traders can profit from. Web the strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. The retracement of the flag should not be higher than 50% compared to the flag pole. Web the strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. How to trade flag patterns? Web both the bull flag and the bear flag slant against their respective trends — the bull flag against the uptrend and the bear flag against the downtrend — signaling a brief lull in. When a bear flag unfurls, traders brace for action. Bull flags and bear flags are price patterns.How To Trade Bull Flag Patterns Rich Tv

Bybit Learn What Is A Bull Flag Pattern (Bullish) & How to Trade With It

How to Trade Bearish Flag and the Bullish Flag Chart Patterns Forex

Bull Flag and Bear Flag Chart Patterns Explained

Bull Flag vs Bear Flag Predict Shortterm Trends Phemex Academy

Bull Flag and Bear Flag Chart Patterns Explained

Bull Flag & Bear Flag Pattern Trading Strategy Guide (Updated 2023)

Bull Flag vs Bear Flag and How to Trade Them Properly Forex, Trading

Trade High Probability Bull Flag Vs Bear Flag Chart Patterns

Bull Flag and Bear Flag pattern for Intraday Trading. YouTube

Web Bull Flag Vs Bear Flags:

Distinguish Between A Bull Flag And Bear Flag Chart Pattern By Spotting The Direction Of The Pole, And Expect A Breakout In The Direction Of The.

Web Bull Flag Vs Bear Flag Are Powerful Chart Patterns For Trading Trend Continuations.

Web Bull Flag Vs Bear Flag, This Guide Will Explain The Difference Between The Two Of The Most Popular Patterns And How To Trade Them Accurately.

Related Post: