Diamond Bottom Pattern

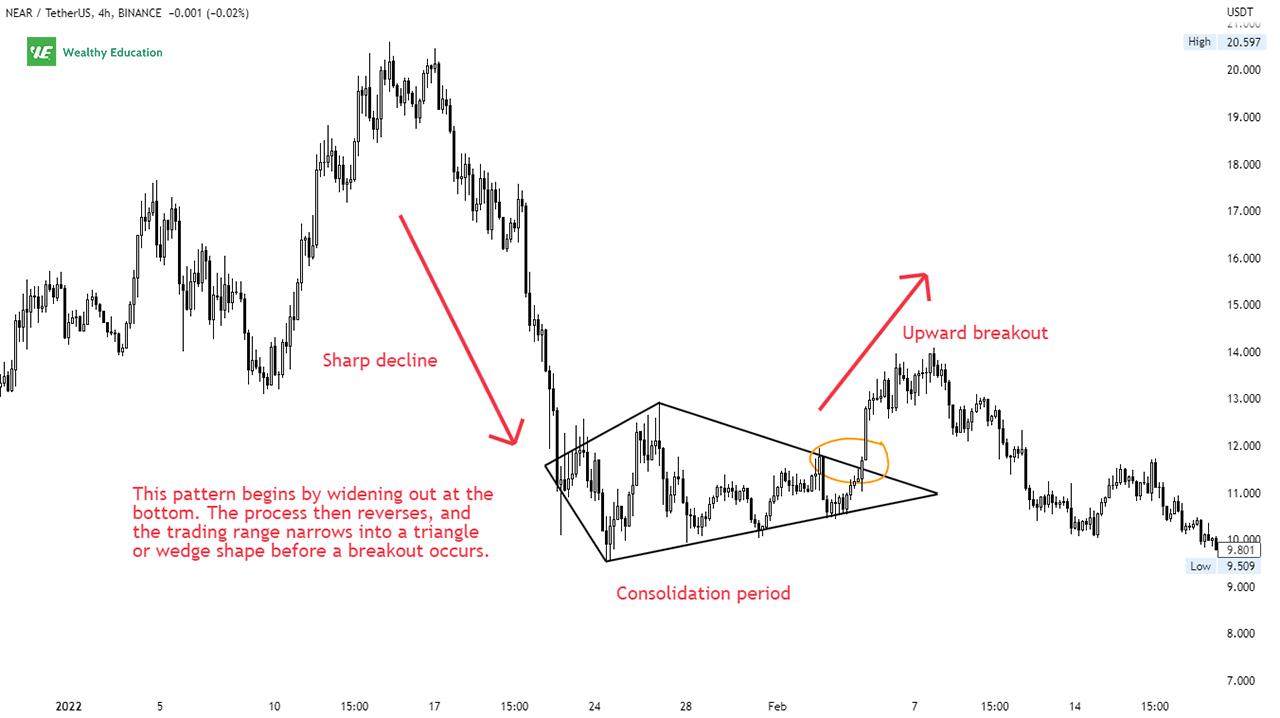

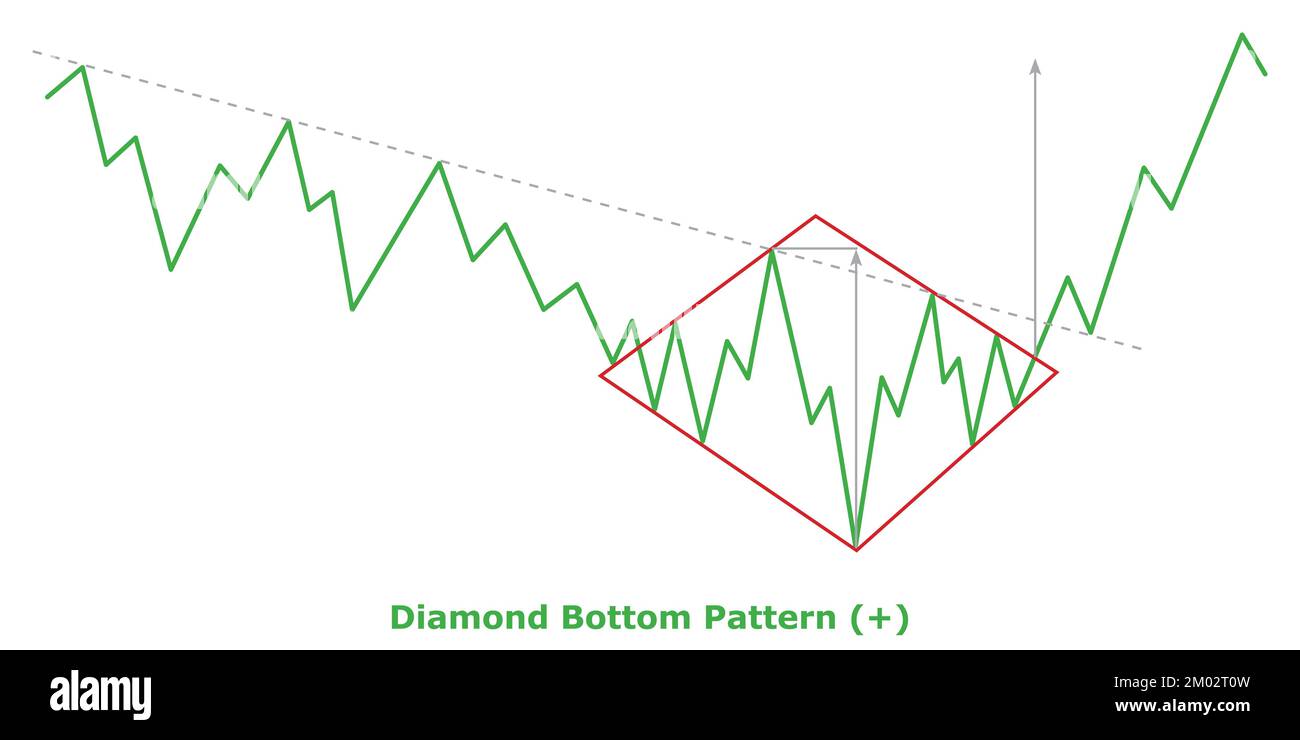

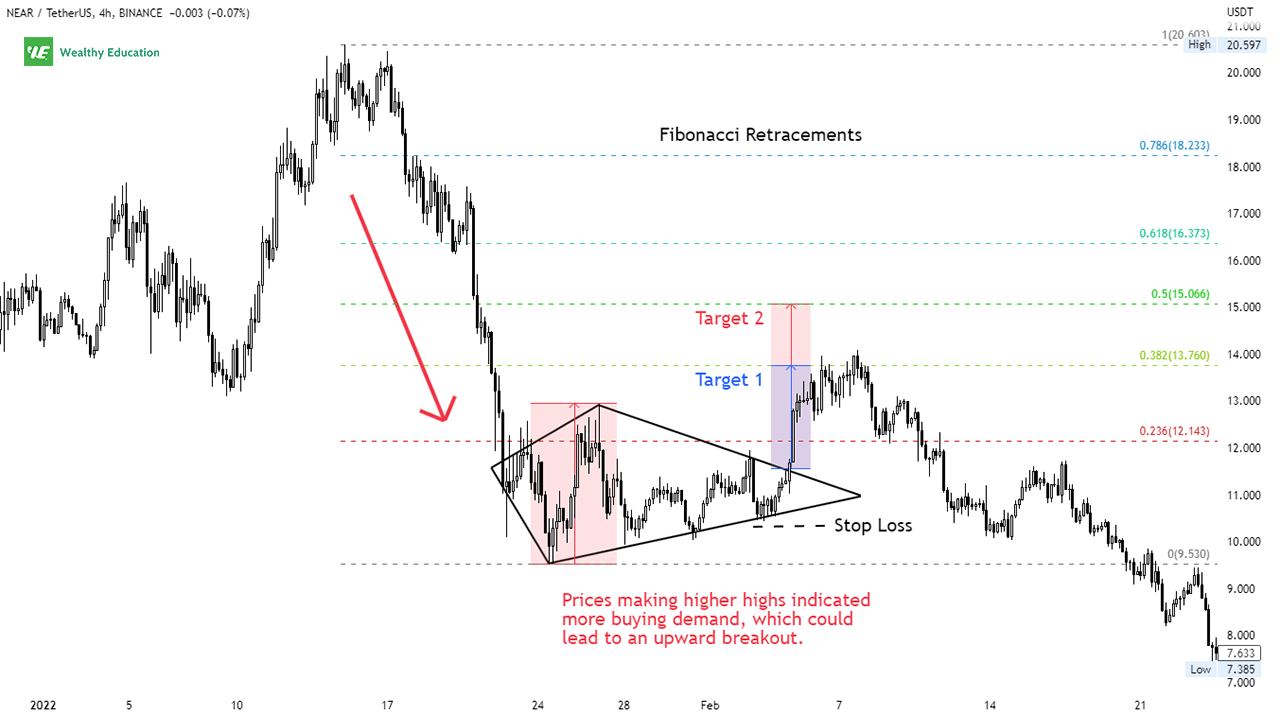

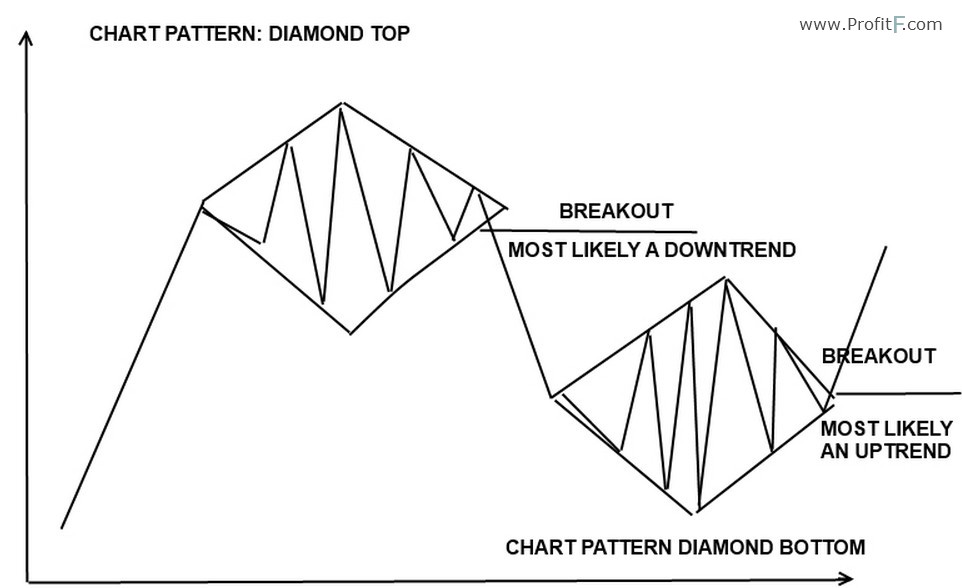

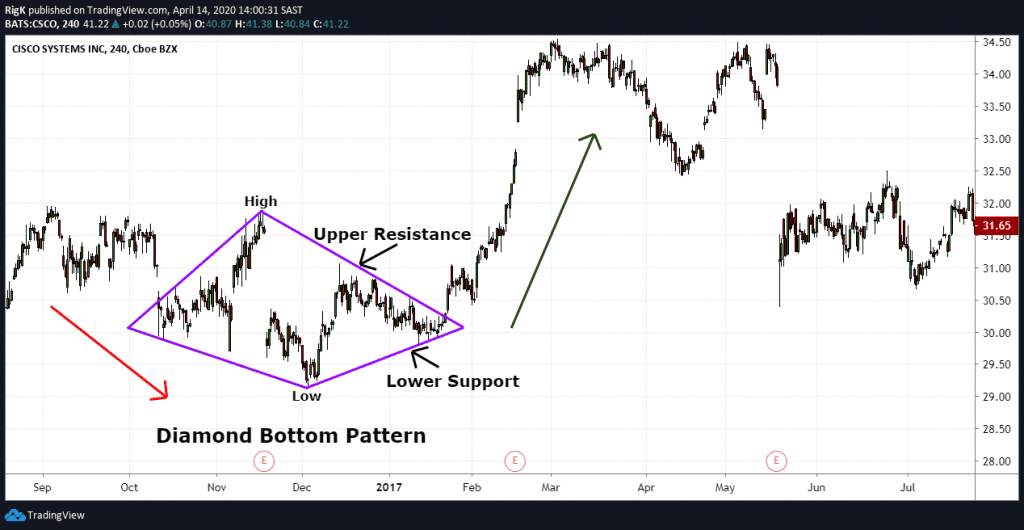

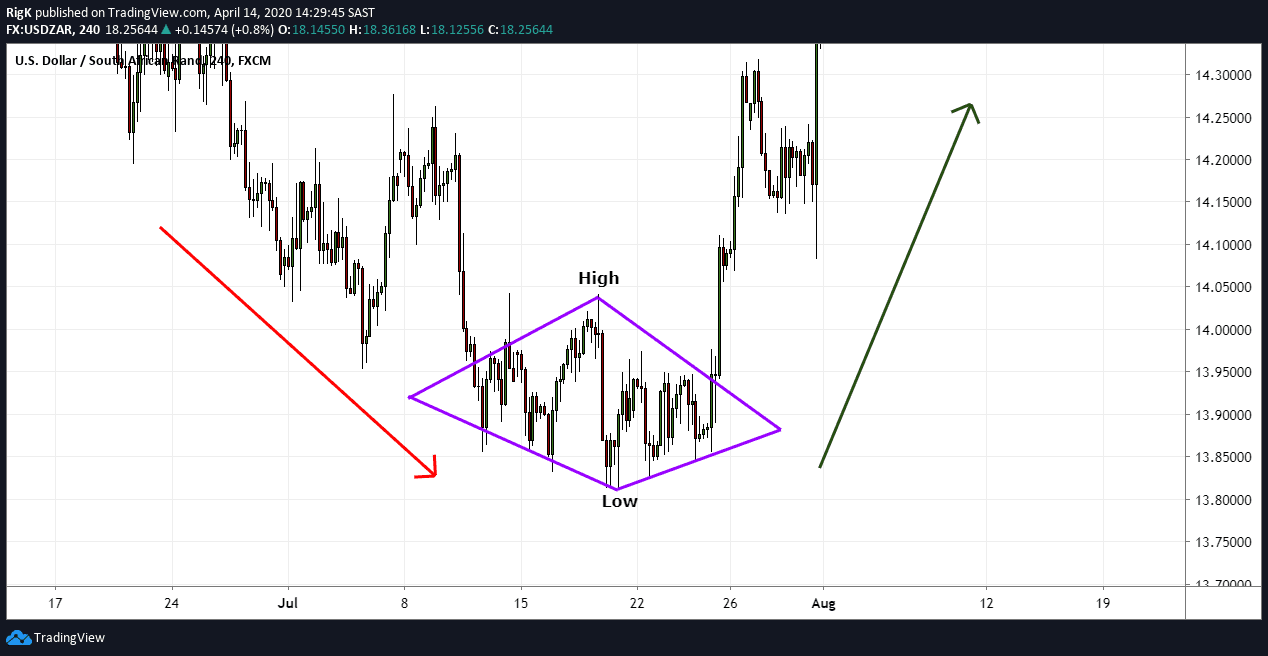

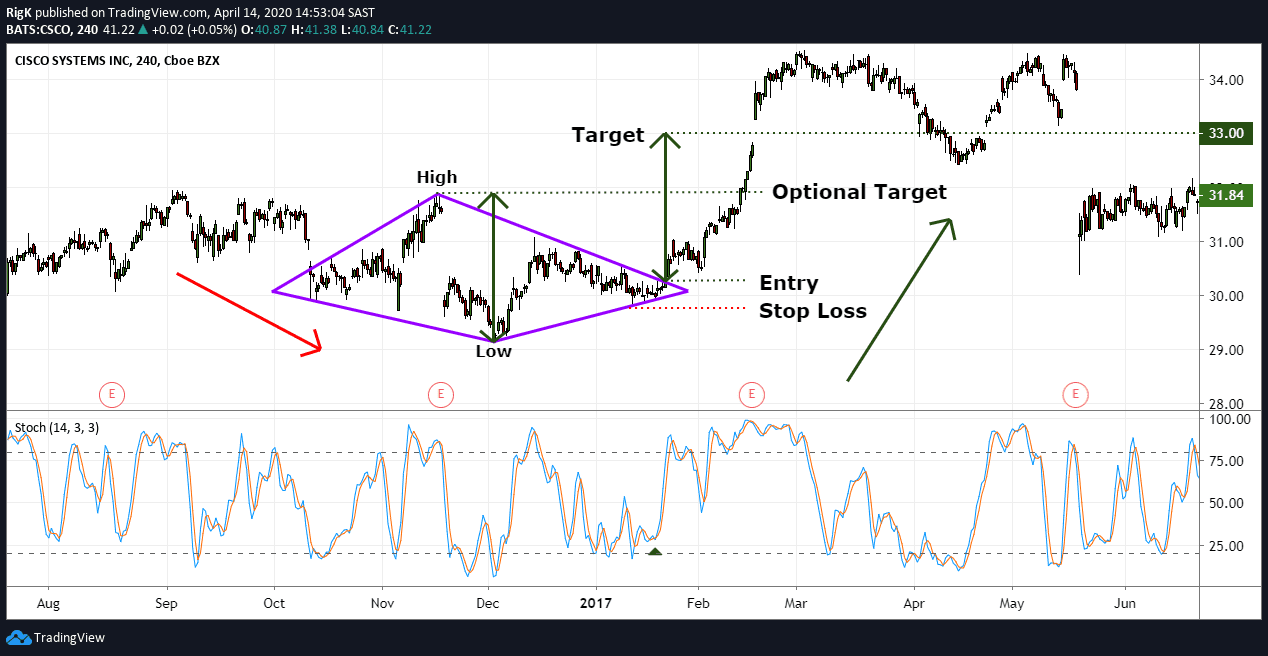

Diamond Bottom Pattern - Web the diamond bottom pattern is a technical analysis tool indicative of a potential reversal in market trends. Diamond bottoms form at a market bottom at the end of a bearish trend and are a bullish signal. Bullish diamond pattern (diamond bottom) bearish diamond pattern (diamond top) This article will explore the diamond chart patterns and how they are formed. It consists of two symmetrical triangles Web a diamond bottom pattern is a bullish pattern that signals a bearish to bullish price reversal from a downtrend to an uptrend. In a diamond pattern, the price action carves out a symmetrical shape that resembles a diamond. A diamond bottom pattern is a chart formation used in technical analysis, which typically occurs at the end of a significant downtrend. This pattern is seen as a bullish signal, suggesting a potential reversal of the trend. Web diamond bottoms are diamond shaped chart patterns. However, it could easily be mistaken for a head and shoulders pattern. The price reversal happens after the formation of the top and bottom at point d. Then the trading range gradually narrows after the highs peak and the lows start trending upward. The technical event occurs when prices break upward out of the diamond formation. In a diamond pattern, the price action carves out a symmetrical shape that resembles a diamond. This pattern is seen as a bullish signal, suggesting a potential reversal of the trend. The bullish diamond pattern and the bearish diamond pattern. Web diamond bottoms are diamond shaped chart patterns. Web the diamond pattern is a reversal indicator that signals the end of a bullish or bearish trend. Web diamond bottom pattern on a chart. A diamond bottom is formed by two juxtaposed symmetrical triangles, so forming a diamond. This pattern begins by widening out at the bottom as sellers are losing control and buyers begin to take over. Web diamond bottoms are diamond shaped chart patterns. Then the trading range gradually narrows after the highs peak and the lows start trending upward. A diamond. It is considered a rare but reliable pattern. Diamond bottom patterns start forming after a downward trend, and it starts to signal a possible reversal to the upside. This pattern begins by widening out at the bottom as sellers are losing control and buyers begin to take over. Web the diamond pattern is a reversal indicator that signals the end. This pattern marks the exhaustion of the selling current and investor indecision. Web diamond bottoms are diamond shaped chart patterns. Web a diamond bottom pattern is a bullish pattern that signals a bearish to bullish price reversal from a downtrend to an uptrend. The technical event occurs when prices break upward out of the diamond formation. Diamond bottoms form at. It is formed by a series of higher highs and lower lows, creating a symmetrical shape that resembles a diamond. Web a diamond bottom pattern is a bullish pattern that signals a bearish to bullish price reversal from a downtrend to an uptrend. The diamond pattern has a reversal characteristic: Web a diamond top formation is a technical analysis pattern. Web a diamond bottom is a bullish, trend reversal chart pattern. It is formed by a series of higher highs and lower lows, creating a symmetrical shape that resembles a diamond. A diamond bottom has to be preceded by a bearish trend. Read more for performance statistics and trading tactics, written by internationally known author and trader thomas bulkowski. It. Web a diamond top formation is a technical analysis pattern that often occurs at, or near, market tops and can signal a reversal of an uptrend. The bullish diamond pattern and the bearish diamond pattern. Diamond patterns often emerging provide clues about future market movements. Web the bullish diamond pattern, sometimes referred to as a diamond bottom pattern, forms during. This article will explore the diamond chart patterns and how they are formed. Then the trading range gradually narrows after the highs peak and the lows start trending upward. This leads to two distinct diamond patterns: Web bullish diamond patterns are known as diamond bottom. Web the diamond pattern is a reversal indicator that signals the end of a bullish. However, it could easily be mistaken for a head and shoulders pattern. Web a diamond bottom is a bullish, trend reversal chart pattern. The diamond pattern has a reversal characteristic: This pattern marks the exhaustion of the selling current and investor indecision. Web bullish diamond patterns are known as diamond bottom. Web a diamond bottom is a bullish, trend reversal, chart pattern. However, it could easily be mistaken for a head and shoulders pattern. It is so named because the trendlines connecting. A diamond bottom is formed by two juxtaposed symmetrical triangles, so forming a diamond. Web first, a diamond top pattern happens when the asset price is in a bullish. The bullish diamond pattern and the bearish diamond pattern. In a diamond pattern, the price action carves out a symmetrical shape that resembles a diamond. A diamond bottom has to be preceded by a bearish trend. This article will explore the diamond chart patterns and how they are formed. This pattern is seen as a bullish signal, suggesting a potential. This pattern begins by widening out at the bottom as sellers are losing control and buyers begin to take over. Web the diamond chart pattern is a technique used by traders to spot potential reversals and make profitable trading decisions. It looks like a rhombus on the chart. A diamond bottom pattern is shaped like a diamond on a price chart. Web the diamond bottom pattern occurs because prices create higher highs and lower lows in a broadening pattern. It is so named because the trendlines connecting. The netflix example, is a diamond bottom pattern. The price reversal happens after the formation of the top and bottom at point d. Web the diamond bottom pattern is a technical analysis tool indicative of a potential reversal in market trends. Web the diamond bottom pattern is a powerful chart formation that signals a bullish trend reversal in forex trading. In a diamond pattern, the price action carves out a symmetrical shape that resembles a diamond. Considered a bullish pattern, the diamond bottom pattern will show a reversal of a trend that breaks out from a downward (bearish) momentum into an upward (bullish) momentum. Second, the price will form what seems like a broadening wedge pattern. Typically we will see a strong price move lower, and then a consolidation phase that carves out the up and down swing points of the diamond bottom. Diamond bottoms form at a market bottom at the end of a bearish trend and are a bullish signal. Web a diamond top formation is a technical analysis pattern that often occurs at, or near, market tops and can signal a reversal of an uptrend.Diamond Pattern Trading Explained

Diamond Chart Pattern Explained Forex Training Group

Diamond bottom efficient Forex pattern Litefinance

Diamond Bottom Pattern (Updated 2023)

Diamond Bottom Pattern Bullish (+) Green & Red Bullish Reversal

Diamond Bottom Pattern (Updated 2022)

Diamond Reversal Chart Pattern in Forex technical analysis

What Are Chart Patterns? (Explained)

Diamond Bottom Pattern Definition & Examples

Diamond Bottom Pattern Definition & Examples

It Usually Forms At The Low Point Of Decline And Is Seen As Relatively Uncommon Compared To Other Chart Patterns.

It Is Formed By A Series Of Higher Highs And Lower Lows, Creating A Symmetrical Shape That Resembles A Diamond.

Web What Is A Diamond Bottom Pattern, And Can You Give An Example?

A Diamond Bottom Has To Be Preceded By A Bearish Trend.

Related Post: