Hammer Pattern Stock

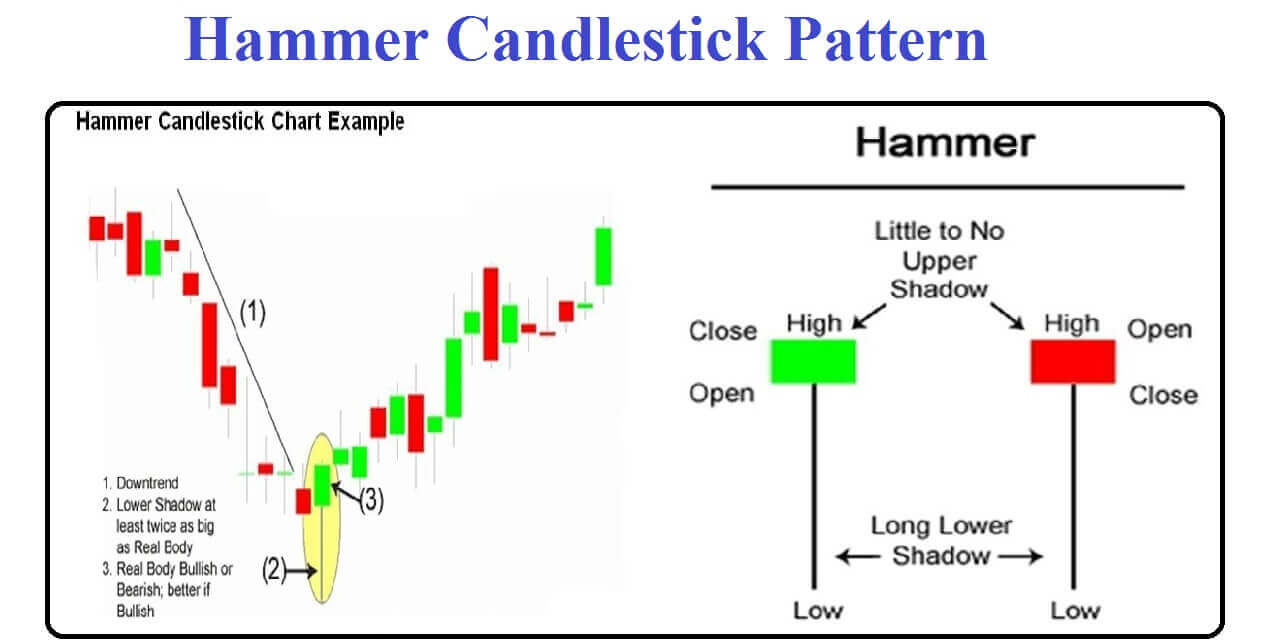

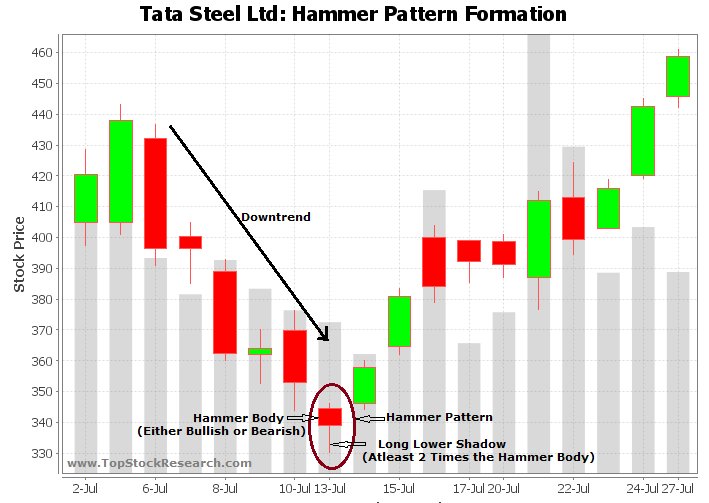

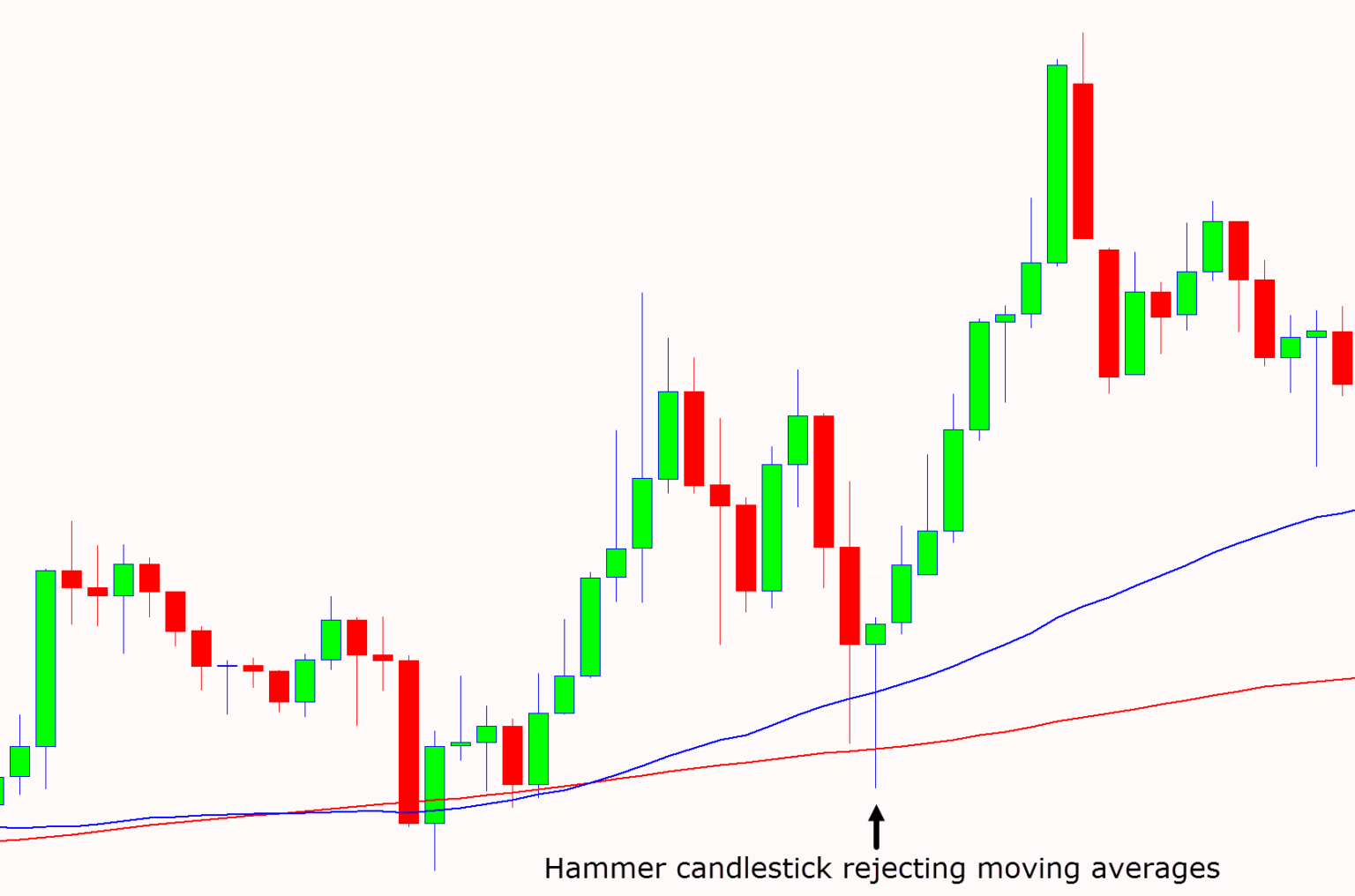

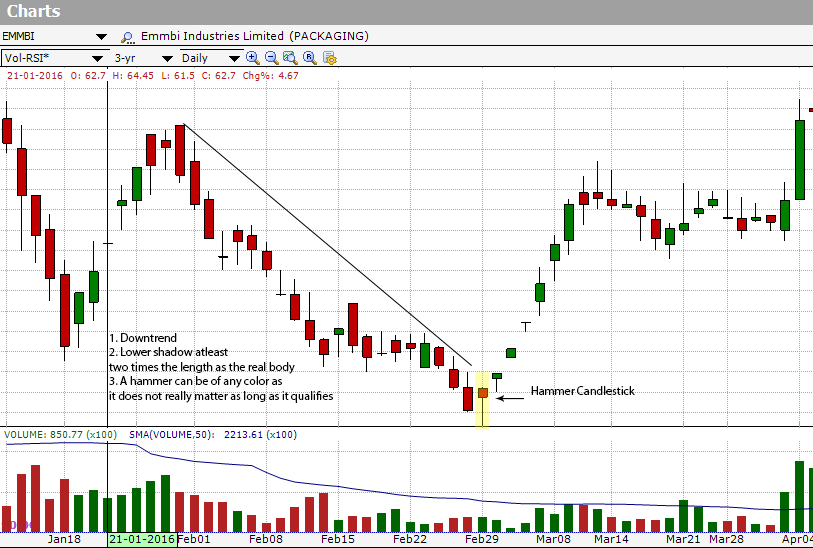

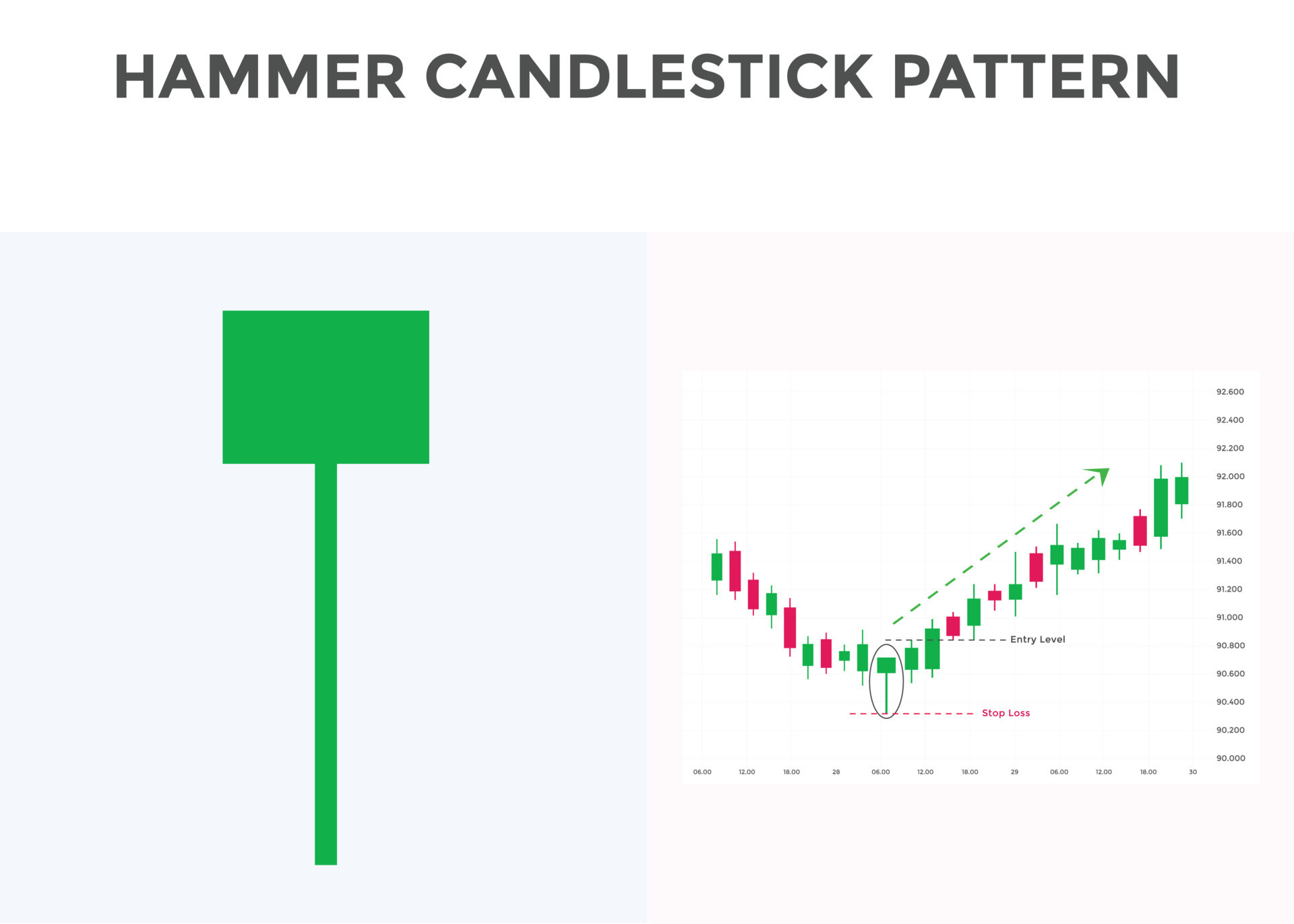

Hammer Pattern Stock - While the stock has lost 6.2% over the past week, it could witness a trend reversal as a hammer chart pattern was formed in its last. When you see a hammer candlestick, it's often seen as a positive sign for investors. The price reached new lows but closed at a higher level due to resultant buying pressure. The body of the candle is short with a longer lower shadow. Web the hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. Candlestick generally forms at the bottom of a downtrend, suggesting that sellers are losing. A hammer is a one day price pattern that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its opening price. If the candlestick is green or. Web a bullish trading pattern known as the hammer candlestick indicates that a stock has reached a bottom and is about to see a trend reversal. Web this page provides a list of stocks where a specific candlestick pattern has been detected. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. In candlestick charting, it points to a bullish reversal. It is a price pattern that usually occurs at the lower end of a down trend. It signals that the market is about to change trend direction and advance to new heights. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. Web stock investors should be ecstatic. Our guide includes expert trading tips and examples. This shows a hammering out of a base and reversal setup. Our guide includes expert trading tips and examples. They consist of small to medium size lower shadows, a real body, and little to no upper wick. The formation of a hammer. The price reached new lows but closed at a higher level due to resultant buying pressure. Web a bullish trading pattern known as the hammer candlestick indicates that a. If the candlestick is green or. It indicates that when sellers entered the market and pushed prices lower, buyers eventually outnumbered sellers and raised the asset’s price. This could mean that the bulls have been able to counteract the bears to help the stock find support. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of. When you see a hammer candlestick, it's often seen as a positive sign for investors. What is a hammer candlestick? This pattern appears like a hammer, hence its name: In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. Web the hanging man candlestick pattern is characterized by a. While the stock has lost 6.2% over the past week, it could witness a trend reversal as a hammer chart pattern was formed in its last. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Web economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in. Our guide includes expert trading tips and examples. The formation of a hammer. Web the hammer candlestick pattern is formed when the stock opens at a higher price and then it gives up gains to trade at a price that is significantly lower than the opening price. The body of the candle is short with a longer lower shadow. The. Web economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading, forex trading (foreign exchange trading), and other marketplaces. Web a downtrend has been apparent in reddit inc. This shows a hammering out of a base and reversal setup. Stock market on average has produced the bulk of its gains when congress is. Look for a break above the. Candlestick generally forms at the bottom of a downtrend, suggesting that sellers are losing. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. If the candlestick is green or. A hammer is a one day price pattern that occurs when a security trades significantly lower than. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. Web hammer technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Web economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading, forex trading (foreign exchange trading), and other marketplaces. In candlestick charting, it points to. This could mean that the bulls have been able to counteract the bears to help the stock find support. It is characterized by a small body and a long lower wick, resembling a hammer, hence its name. A hammer is a one day price pattern that occurs when a security trades significantly lower than its opening, but rallies later in. Web stock investors should be ecstatic. A hammer is a one day price pattern that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its opening price. When you see a hammer candlestick, it's often seen as a positive sign for investors. This is good news for investors because the u.s. Stock market on average has produced the bulk of its gains when congress is in recess. The hammer candle typically appears at the end of a downtrend, indicating a potential reversal in price movement. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. Web a hammer candle is a popular pattern in chart technical analysis. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. Web economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading, forex trading (foreign exchange trading), and other marketplaces. While the stock has lost 6.2% over the past week, it could witness a trend reversal as a hammer chart pattern was formed in its last trading session. This shows a hammering out of a base and reversal setup. These candles are typically green or white on stock charts. Web the hammer is a bullish reversal pattern, which signals that a stock is nearing the bottom in a downtrend. If the candlestick is green or. The price reached new lows but closed at a higher level due to resultant buying pressure.Hammer Candlestick Pattern Trading Guide

How to trade Hammer Candlestick Pattern 2024 CoinCodeCap Crypto Signals

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

What is Hammer Candlestick Pattern June 2024

Tutorial on Hammer Candlestick Pattern

Hammer Candlestick Pattern Trading Guide

Hammer, Inverted Hammer & Hanging Man Candlestick Chart Patterns

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

Hammer pattern candlestick chart pattern. Bullish Candlestick chart

Powerful Hammer Candlestick Pattern Formation, Example and

Web The Hammer Candlestick Is A Significant Pattern In The Realm Of Technical Analysis, Vital For Predicting Potential Price Reversals In Markets.

Web Hammer Technical & Fundamental Stock Screener, Scan Stocks Based On Rsi, Pe, Macd, Breakouts, Divergence, Growth, Book Vlaue, Market Cap, Dividend Yield Etc.

The Opening Price, Close, And Top Are Approximately At The Same Price, While There Is A Long Wick That Extends Lower, Twice As Big As The Short Body.

A Downtrend Has Been Apparent In Reddit Inc.

Related Post: