Hanging Man Candlestick Pattern

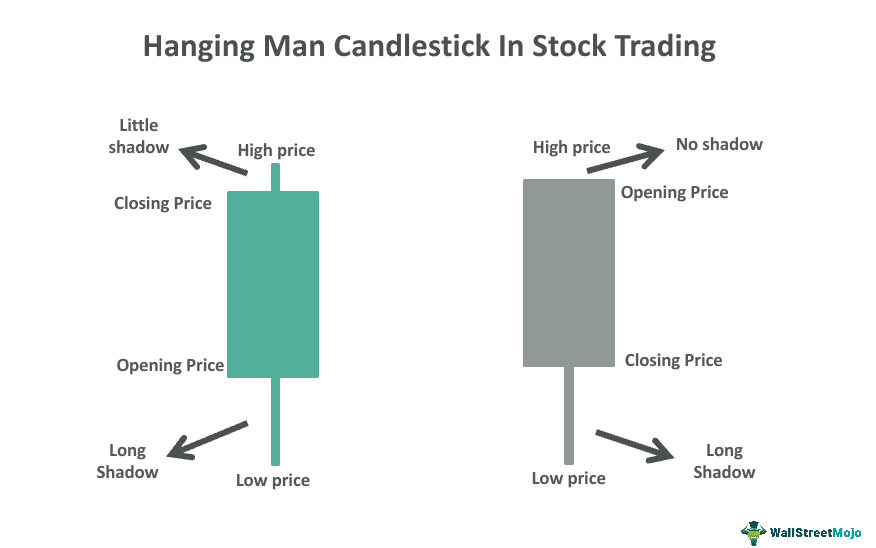

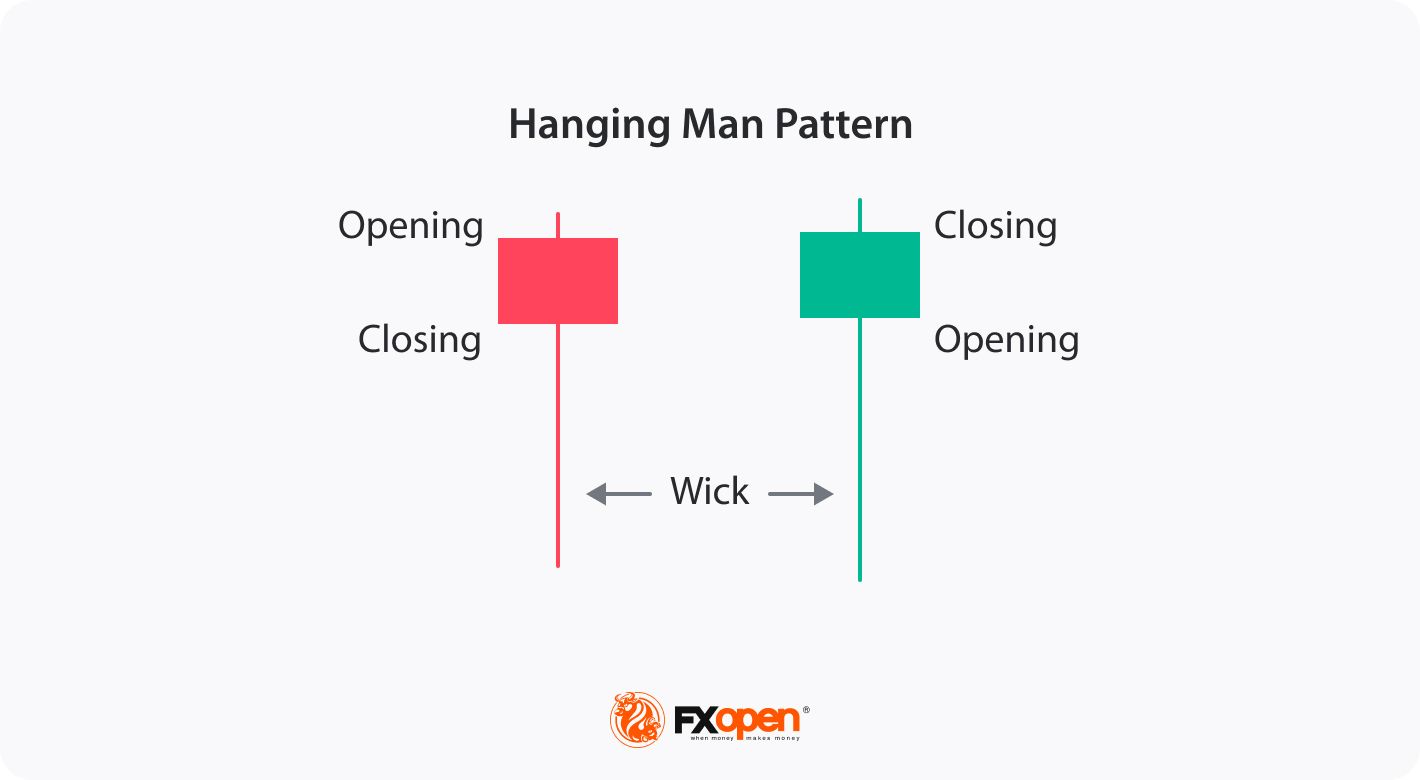

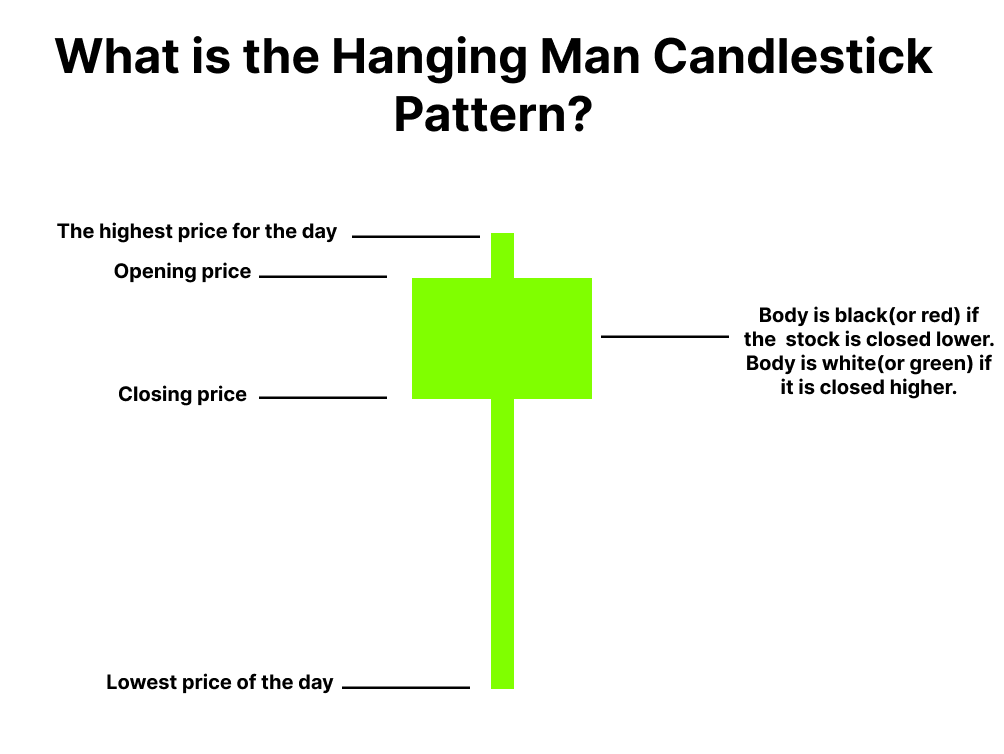

Hanging Man Candlestick Pattern - Web the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. The hanging man is a single candlestick pattern that appears after an uptrend. Web hanging man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. Web the hanging man candlestick pattern is one pattern that affirms the seller’s footprint after a long bullish swing. The candle is formed by a long lower shadow coupled with a small real. Web the hanging man is probably one of the better known candlestick patterns, but it does not work as many expect. Candle theory says it acts as a bearish reversal of the prevailing price trend, but my tests show that it is really a bullish continuation 59% of the time. The hanging man is one of the best crypto and forex candlestick patterns. How to identify and use the hanging man candlestick? This article will cover identifying, interpreting, and trading the hanging man. What is the hanging man candlestick? The hanging man is a single candlestick pattern that appears after an uptrend. Web the hanging man candlestick pattern is one pattern that affirms the seller’s footprint after a long bullish swing. This is generally brought about by many. A long lower shadow or wick Long white candle, formed at a high trading volume was enough to cancel the hangin man. Consider the bulls and bears war as a football game when stock trading. Variants of the hanging man candlestick pattern. What does hanging man pattern indicate. Web the hanging man is a candlestick pattern (bearish candlestick) that appears at the top of a bullish trend and provides a bearish reversal pattern. Web what is the hanging man candlestick pattern? Web the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. While the underlying trend doesn’t need to be bullish for the hanging candlestick to appear, there must be a price rise before the pattern appears and changes the price. A long lower shadow or wick It is characterized by a small body at the upper end of the candle and a long lower wick, at least twice the length of the body. What is the hanging man candlestick? Of course, that is what i call near random. Specifically, the hanging man candle has: The long wick or shadow is a good indication to traders that sellers are really aggressively trying to halt the uptrend. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. What does hanging man pattern indicate. Of course, that is what i call near random.. It is a sign of weakness in the asset’s ability to sustain an uptrend. Specifically, the hanging man candle has: Web what is the hanging man candlestick pattern. After a long bullish trend, this pattern is a warning that the trend may reverse soon, as the bulls appear to be losing momentum. Traders utilize this pattern in the trend direction. The hanging man is one of the best crypto and forex candlestick patterns. Web the hanging man is a japanese candlestick pattern that signals the reversal of an uptrend. Long white candle, formed at a high trading volume was enough to cancel the hangin man. What is the hanging man candlestick? Of course, that is what i call near random. Long white candle, formed at a high trading volume was enough to cancel the hangin man. It has the appearance of the hammer pattern — small body and long lower shadow — but unlike the latter, the hanging man is. Web the hanging man is a candlestick pattern (bearish candlestick) that appears at the top of a bullish trend and. How to identify and use the hanging man candlestick? Web a hanging man candle (aptly named) is a candlestick formation that reveals a sharp increase in selling pressure at the height of an existing uptrend. It is formed when the bulls have pushed the prices up and now they are not able to push further. Of course, that is what. What is the hanging man candlestick? Candle theory says it acts as a bearish reversal of the prevailing price trend, but my tests show that it is really a bullish continuation 59% of the time. Web the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. After a. It is characterized by a small body at the upper end of the candle and a long lower wick, at least twice the length of the body. How to identify the hanging man candlestick pattern. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long. Consider the bulls and bears war as a football game when stock trading. It forms at the top of an uptrend and has a small real body, a long lower shadow, and little to no upper shadow. The figure presents two occurrences of the hanging man pattern. It is an early warning to the bulls that the bears are coming.. Specifically, the hanging man candle has: Web what is the hanging man candlestick pattern. Web a hanging man candle (aptly named) is a candlestick formation that reveals a sharp increase in selling pressure at the height of an existing uptrend. Variants of the hanging man candlestick pattern. The hanging man candlestick pattern, as one could predict from the name, is viewed as a bearish reversal pattern. It is formed when the bulls have pushed the prices up and now they are not able to push further. Web the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. Candle theory says it acts as a bearish reversal of the prevailing price trend, but my tests show that it is really a bullish continuation 59% of the time. Web the hanging man is a candlestick pattern (bearish candlestick) that appears at the top of a bullish trend and provides a bearish reversal pattern. Web a hanging man candlestick is a bearish chart pattern used in technical analysis that potentially indicates a market reversal. The candle is formed by a long lower shadow coupled with a small real. Web what is a hanging man candlestick pattern? This is generally brought about by many. How to trade the hanging man candlestick pattern. Consider the bulls and bears war as a football game when stock trading. This candlestick pattern appears at the end of the uptrend indicating weakness in further price movement.The Hanging Man Candlestick Pattern A Trader’s Guide TrendSpider

What Is Hanging Man Pattern & How to Trade Using It Finschool

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube

Hanging Man Candlestick Pattern Trading Strategy

Hanging Man Candlestick Pattern (How to Trade and Examples)

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

Understanding the 'Hanging Man' Candlestick Pattern

Hanging Man Candlestick Pattern Meaning, Explained, Examples

Understanding the Hanging Man Candlestick Pattern Market Pulse

If The Candlestick Is Green Or White,.

Web Hanging Man Is A Bearish Reversal Candlestick Pattern That Has A Long Lower Shadow And A Small Real Body.

Web The Hanging Man Candlestick Pattern Is Characterized By A Short Wick (Or No Wick) On Top Of Small Body (The Candlestick), With A Long Shadow Underneath.

After A Long Bullish Trend, This Pattern Is A Warning That The Trend May Reverse Soon, As The Bulls Appear To Be Losing Momentum.

Related Post:

![Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube](https://i.ytimg.com/vi/IgS8pO3g71U/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)