Shooting Star Stock Pattern

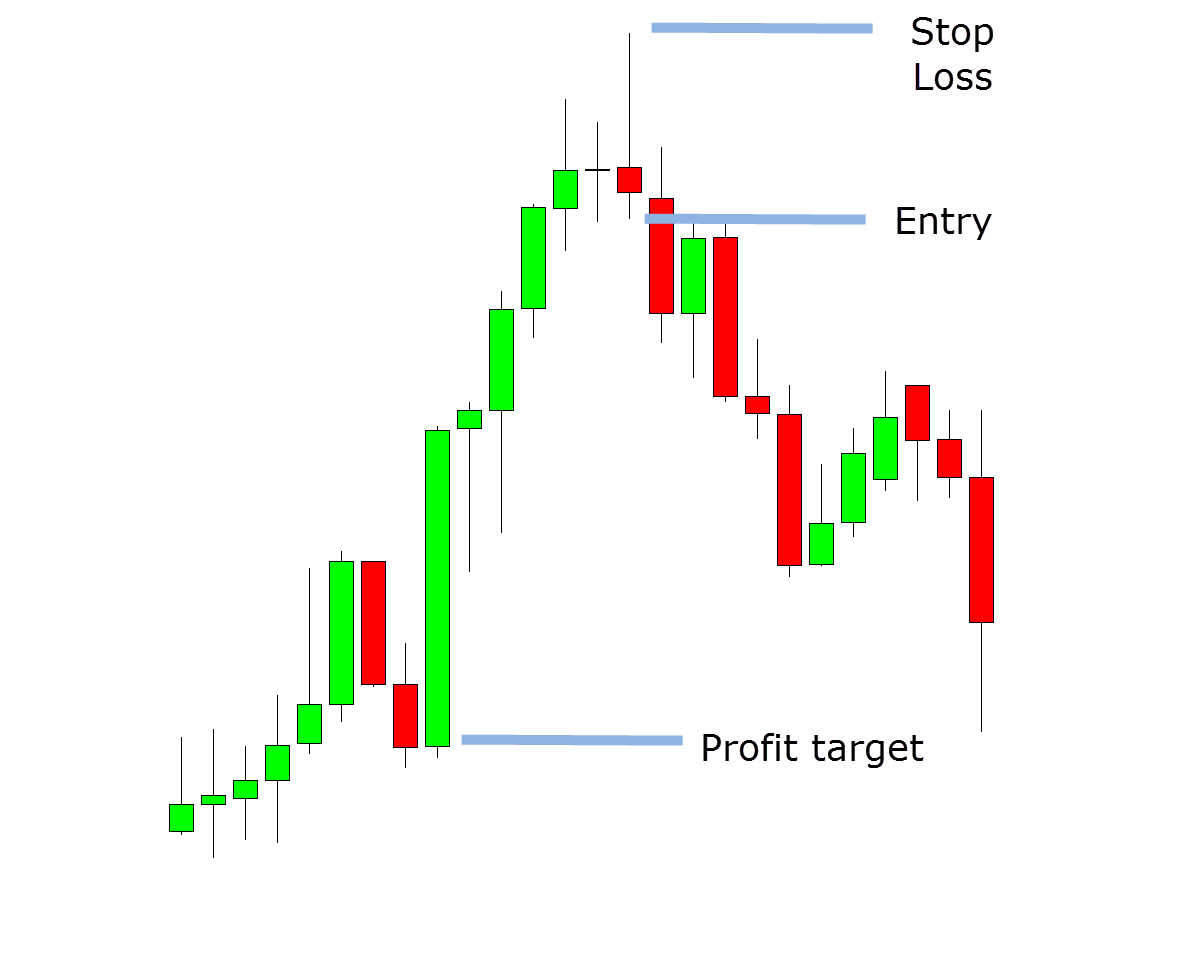

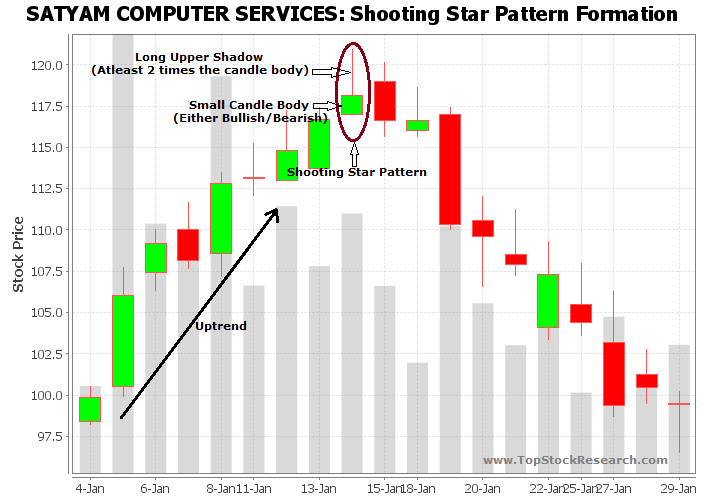

Shooting Star Stock Pattern - Here’s how to recognize it: And this is what a shooting star means… This pattern is the most effective when it forms after a series of rising bullish candlesticks. Little to no lower shadow. Web the shooting star pattern reveals a significant price advance within a trading session, followed by selling pressure that brings the price back down near its open. This pattern is characterized by a long upper shadow and a small real body near the low of the trading range, indicating potential weakness among the buyers. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the open, low, and close are near the bottom of the candle. This guide will help you understand this pattern, shedding light on its structure and relevance in trading. When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. It is also one of the four types of stars in candle theory: The pattern forms when a security price opens, advances significantly, but then retreats during the period only to close near the open again. It has a bigger upper wick, mostly twice its body size. This pattern represents a potential reversal in an uptrend. Little to no lower shadow. This pattern is characterized by a long upper shadow and a small real body near the low of the trading range, indicating potential weakness among the buyers. A shooting star occurs after an advance and indicates the price could start falling. Web what is a shooting star candlestick pattern? The inverted hammer occurs at the end of a down trend. That being said, you can also have variations of the two. It is formed when a candlestick opens and moves up but after that price moves down coming back to the opening price and closes near the opening price leaving a long wick to the upside called tail. Web a shooting star is a type of candlestick pattern that forms when the price of the security opens, rises significantly but then. It is a popular reversal candlestick pattern that occurs frequently in technical analysis and is simple and easy to identify. This creates a long upper wick, a small lower wick and a small body. For example, you can have a hammer candlestick pattern at the top of an uptrend which will also signal a reversal. Web what is a shooting. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the open, low, and close are near the bottom of the candle. Web the shooting star candlestick pattern is a bearish reversal pattern. Web sun, july 21, 2024, 8:28 am edt · 1 min read. Web here we introduce the shooting star pattern —. Each bullish candlestick should create a higher high. The formation is bearish because the price tried to rise significantly during the day, but. It is also one of the four types of stars in candle theory: The inverted hammer occurs at the end of a down trend. It has a bigger upper wick, mostly twice its body size. Here’s how to recognize it: This guide will help you understand this pattern, shedding light on its structure and relevance in trading. That being said, you can also have variations of the two. It is a popular reversal candlestick pattern that occurs frequently in technical analysis and is simple and easy to identify. After an uptrend, the shooting star pattern. Web what is a shooting star pattern in candlestick analysis? That being said, you can also have variations of the two. A shooting star occurs after an advance and indicates the price could start falling. Web a shooting star pattern is a powerful bearish reversal candlestick pattern that occurs after an uptrend in trading. When this pattern appears in an. The distance between the highest price of the day and the opening price should be more than twice as large as the shooting star’s body. It’s a reversal pattern believed to signal an imminent bearish trend reversal. Web a shooting star is a type of candlestick pattern that forms when the price of the security opens, rises significantly but then. The formation is bearish because the price tried to rise significantly during the day, but. It is seen after an asset’s market price is pushed up quite significantly but then gets rejected at higher prices, which indicates that the price may be about to decline. A shooting star candlestick pattern is a chart formation that occurs when an asset’s market. It is seen after an asset’s market price is pushed up quite significantly but then gets rejected at higher prices, which indicates that the price may be about to decline. The inverted hammer occurs at the end of a down trend. Web what is a shooting star pattern in candlestick analysis? This pattern is characterized by a long upper shadow. You might be shocked that you’ll lose money if you trade this pattern. On the 1200 block of north alden. Web a shooting star formation is a bearish reversal pattern that consists of just one candle. It is seen after an asset’s market price is pushed up quite significantly but then gets rejected at higher prices, which indicates that the. Web the shooting star candlestick is a chart formation consisting of a candlestick with a small real body, and a large upper shadow. This creates a long upper wick, a small lower wick and a small body. And this is what a shooting star means… You might be shocked that you’ll lose money if you trade this pattern. Web what is a shooting star pattern in candlestick analysis? On the 1200 block of north alden. The price closes at the bottom ¼ of the range. After an uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited. The formation is bearish because the price tried to rise significantly during the day, but. The inverted hammer occurs at the end of a down trend. As its name suggests, the shooting star is a small real body at the lower end of the price range with a long upper shadow. The upper shadow is about 2 or 3 times the length of the body. Each bullish candlestick should create a higher high. This indicates a rejection of higher prices and suggests that a reversal might be forthcoming. It is seen after an asset’s market price is pushed up quite significantly but then gets rejected at higher prices, which indicates that the price may be about to decline. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the open, low, and close are near the bottom of the candle.Understanding the Significance of Shooting Star Candlestick in Trading

How to Trade the Shooting Star Candlestick Pattern IG International

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

How To Trade Blog What Is Shooting Star Candlestick? How To Use It

Shooting Star Candlestick Pattern How to Identify and Trade

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

Tutorial on Shooting Star Candlestick Pattern

Shooting Star Chart Pattern

Shooting Star Candlestick Pattern How to Identify and Trade

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

Web A Shooting Star Pattern Is A Powerful Bearish Reversal Candlestick Pattern That Occurs After An Uptrend In Trading.

A Shooting Star Occurs After An Advance And Indicates The Price Could Start Falling.

The Pattern Forms When A Security Price Opens, Advances Significantly, But Then Retreats During The Period Only To Close Near The Open Again.

This Pattern Is The Most Effective When It Forms After A Series Of Rising Bullish Candlesticks.

Related Post: