Three Special Case Patterns Of Dividend Growth Include

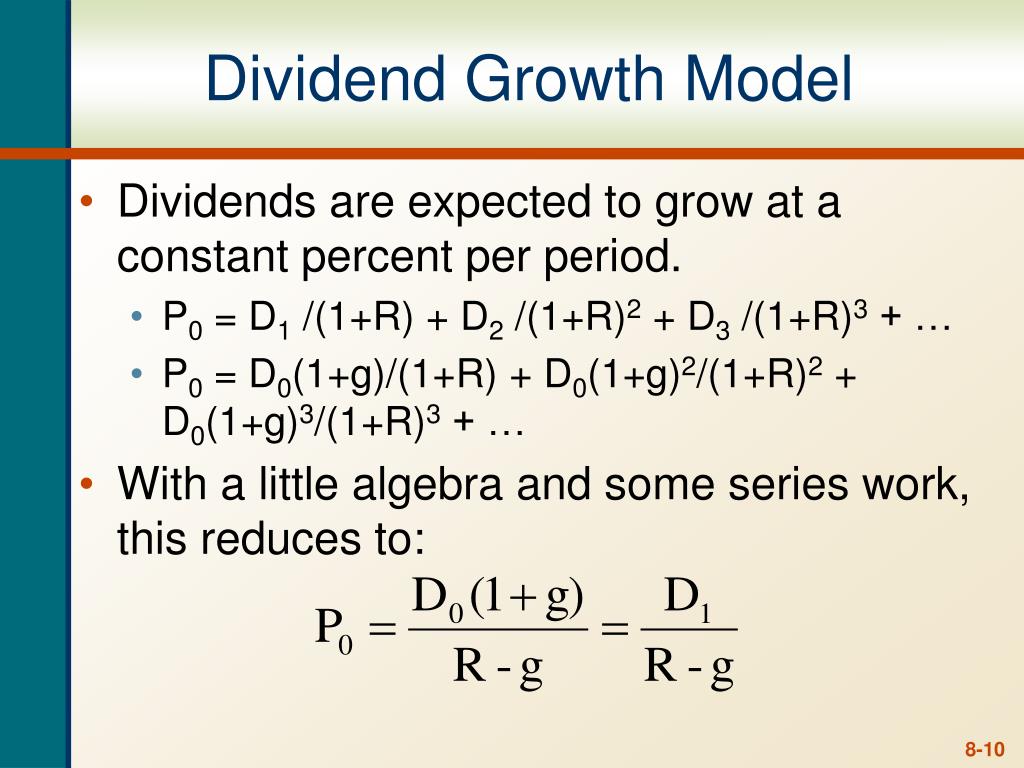

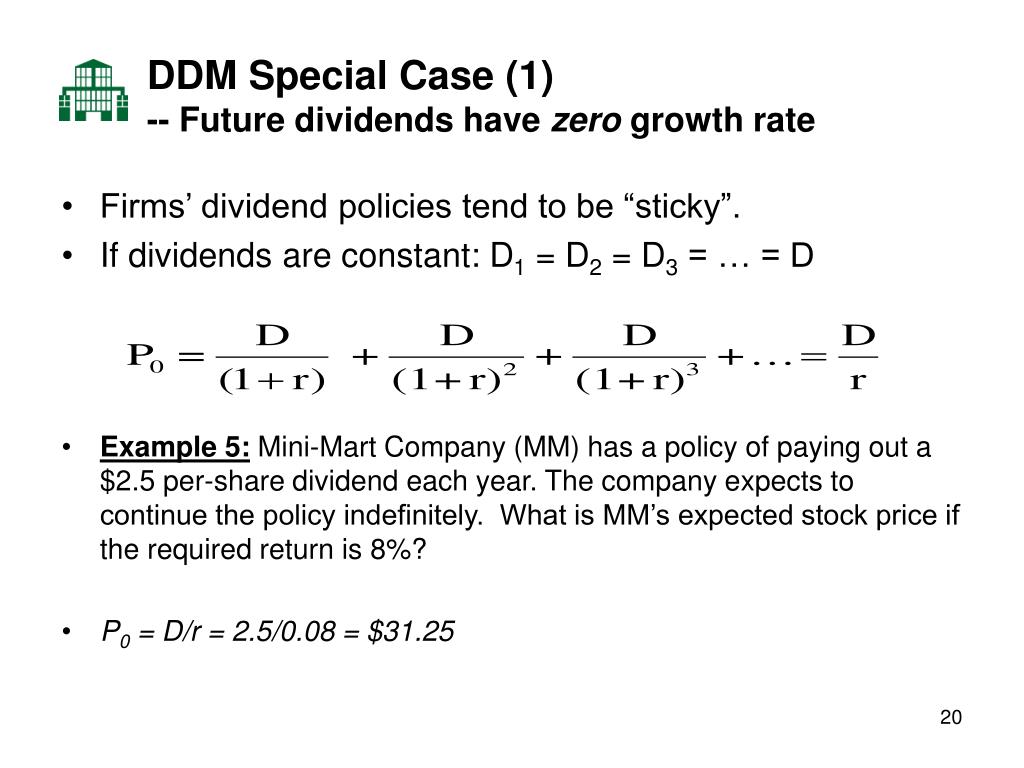

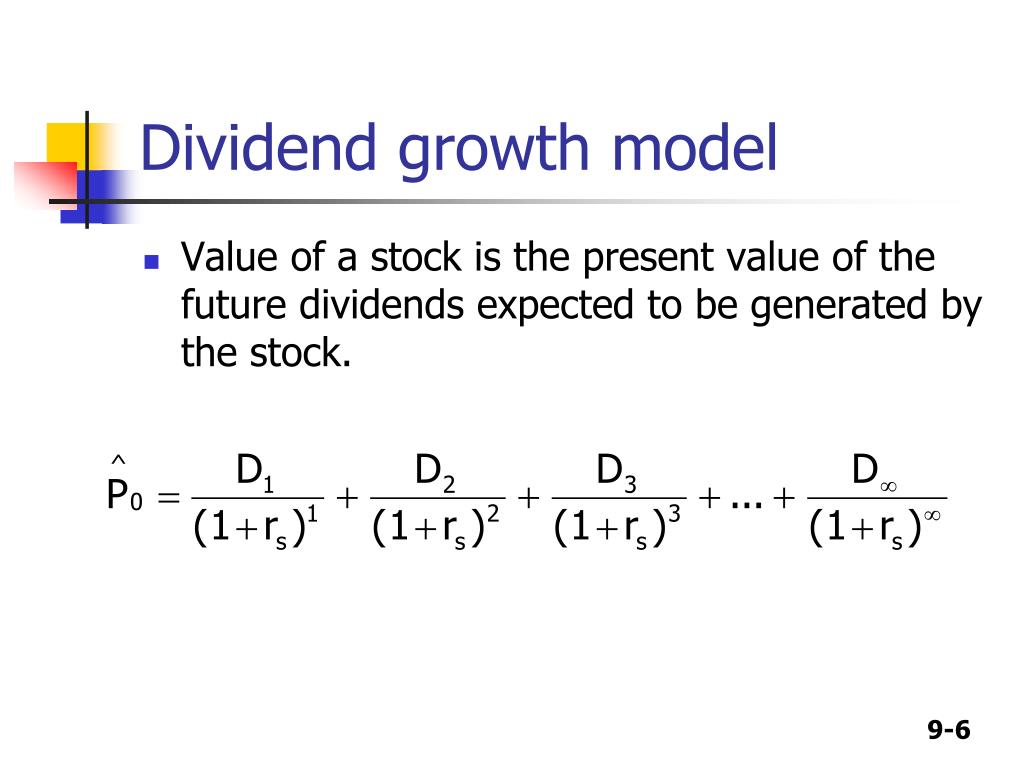

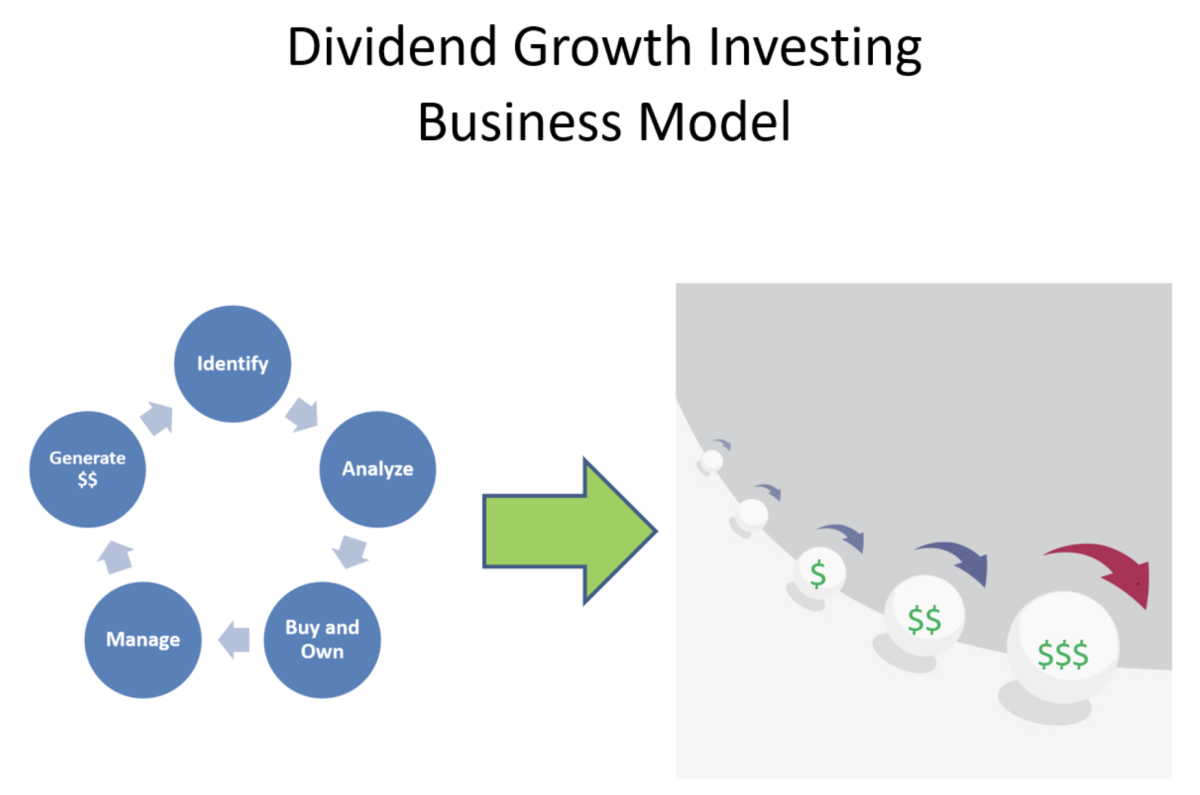

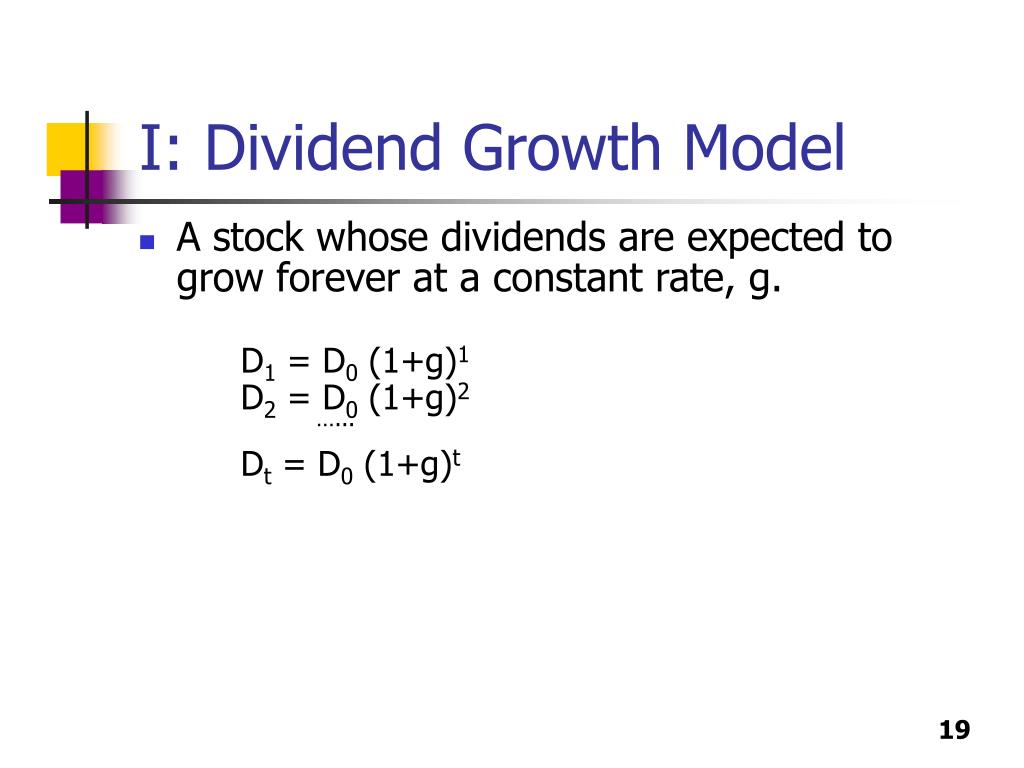

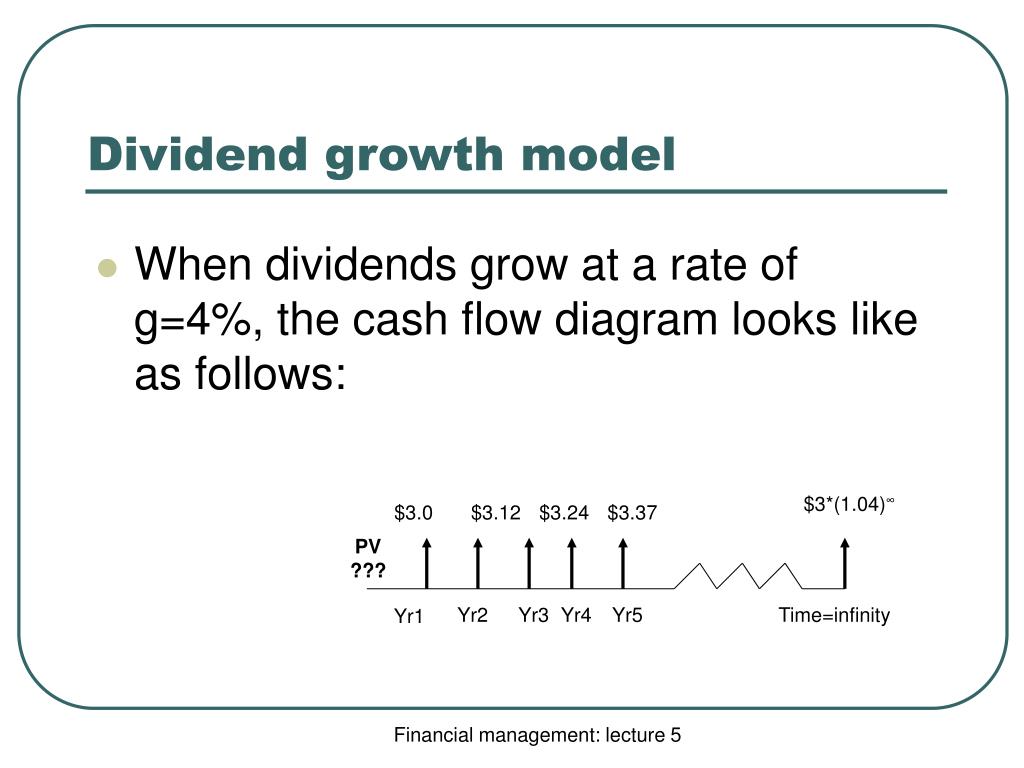

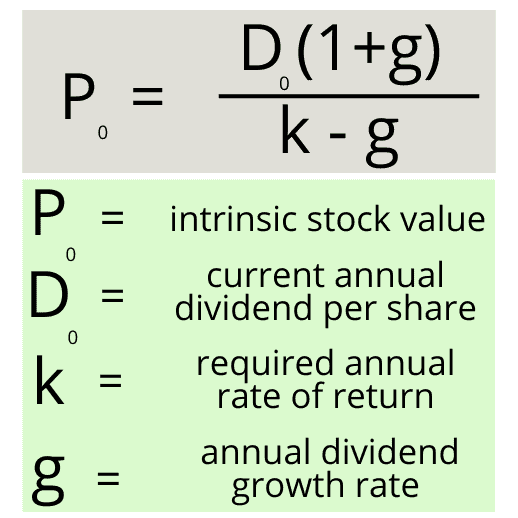

Three Special Case Patterns Of Dividend Growth Include - Web three special case patterns of dividend growth include: Web o three special case patterns of dividend growth discusses in the text include: Web dividend growth stocks could be attractive to market participants looking for disciplined companies that can endure difficult market and economic environments relatively well. A generalized version of the walter model (1956), spm. Which of the following represents the. Web steady growth, erratic growth, and negative growth are three unique patterns of dividend growth. Dividends may grow at a constant rate. The value of a firm is the function of its ______ rate and its _______ rate. Three special case patterns of dividend growth includezero growthnegative growthconstant growthfast growthnonconstant growthdiscounted growth. The peg ratio is a special case in the sum of perpetuities method (spm) equation. Web dividend growth stocks could be attractive to market participants looking for disciplined companies that can endure difficult market and economic environments relatively well. Web if a company's growth for years 1 through 3 is 20% but stabilizes at 5% beginning in year 4, its growth pattern would be described as _______. Web sum of perpetuities method. Web stock valuation based on the dividend discount model typically takes one of three forms depending on what pattern we expect the dividends to follow. There are 3 steps to solve this one. A generalized version of the walter model (1956), spm. Which of the following represents the. Web which one of the following is true about dividend growth patterns? Web steady growth, erratic growth, and negative growth are three unique patterns of dividend growth. Three special case patterns of dividend growth includezero growthnegative growthconstant growthfast growthnonconstant growthdiscounted growth. Web study with quizlet and memorize flashcards containing terms like which of the following are reasons that make valuing a share of stock more difficult than valuing a bond?,. Constant growth, supernormal growth, and zero growth. Three special case patterns of dividend growth discussed in the text include: Web with a regular dividend payment started in december and a special. Web three special case patterns of dividend growth include perpetual growth, variable growth and accelerated growth. Three special case patterns of. Web when the stock being valued does not pay dividends, the dividend growth model can still be used. Which of the following represents the. Web which one of the following is true about dividend growth patterns? Web which one of the following is true about dividend growth patterns? The value of a firm is the function of its ______ rate and its _______ rate. Web stock valuation based on the dividend discount model typically takes one of three forms depending on what pattern we expect the dividends to follow. A generalized version of the walter model. Web stock valuation based on the dividend discount model typically takes one of three forms depending on what pattern we expect the dividends to follow. The value of a firm is the function of its ______ rate and its _______ rate. There are 3 steps to solve this one. Three special case patterns of. Web three special case patterns of. Web o three special case patterns of dividend growth discusses in the text include: Web which one of the following is true about dividend growth patterns? The peg ratio is a special case in the sum of perpetuities method (spm) equation. Web stock valuation based on the dividend discount model typically takes one of three forms depending on what pattern. Three special case patterns of dividend growth includezero growthnegative growthconstant growthfast growthnonconstant growthdiscounted growth. Web which one of the following is true about dividend growth patterns? The peg ratio is a special case in the sum of perpetuities method (spm) equation. The rate of increase in a company's dividends over a. Three special case patterns of dividend growth discussed in. Constant growth, supernormal growth, and zero growth. Web if a company's growth for years 1 through 3 is 20% but stabilizes at 5% beginning in year 4, its growth pattern would be described as _______. Web with a regular dividend payment started in december and a special dividend paid in june, alibaba's 2.66% trailing yield easily trounces the field mostly.. Which of the following represents the. When assuming nonconstant growth in dividends, to avoid the problem. Web sum of perpetuities method. Web stock valuation based on the dividend discount model typically takes one of three forms depending on what pattern we expect the dividends to follow. Web study with quizlet and memorize flashcards containing terms like which of the following. Web when the stock being valued does not pay dividends, the dividend growth model can still be used. Web with a regular dividend payment started in december and a special dividend paid in june, alibaba's 2.66% trailing yield easily trounces the field mostly. The peg ratio is a special case in the sum of perpetuities method (spm) equation. The rate. Dividends may grow at a constant rate. Three special case patterns of dividend growth includezero growthnegative growthconstant growthfast growthnonconstant growthdiscounted growth. The rate of increase in a company's dividends over a. Web three special case patterns of dividend growth include: Web which one of the following is true about dividend growth patterns? Web with a regular dividend payment started in december and a special dividend paid in june, alibaba's 2.66% trailing yield easily trounces the field mostly. Web dividend growth stocks could be attractive to market participants looking for disciplined companies that can endure difficult market and economic environments relatively well. Web three special case patterns of dividend growth discussed in the text include: Web o three special case patterns of dividend growth discusses in the text include: Web three special case patterns of dividend growth include: Web if a company's growth for years 1 through 3 is 20% but stabilizes at 5% beginning in year 4, its growth pattern would be described as _______. The rate of increase in a company's dividends over a. Web sum of perpetuities method. Web three special case patterns of dividend growth include perpetual growth, variable growth and accelerated growth. Web three special case patterns of dividend growth discussed in the text include: Dividends may grow at a constant rate. Three special case patterns of dividend growth includezero growthnegative growthconstant growthfast growthnonconstant growthdiscounted growth. A generalized version of the walter model (1956), spm. Web steady growth, erratic growth, and negative growth are three unique patterns of dividend growth. When assuming nonconstant growth in dividends, to avoid the problem. There are 3 steps to solve this one.PPT Stock Valuation PowerPoint Presentation, free download ID5731035

PPT MBA 643 Managerial Finance Lecture 6 Valuing Bonds and Stocks

PPT CHAPTER 9 Stocks and Their Valuation PowerPoint Presentation

Stock Valuation Chapter 8 ppt download

Lahore School of Economics ppt download

How Dividend Growth Investing Works Dividend Strategists

PPT Valuation of Stocks PowerPoint Presentation, free download ID

PPT Stock and Its Valuation PowerPoint Presentation, free download

Gordon Growth Model Guide, Formula & 5 Examples Dividends Diversify

Dividend Discount Model Special Cases YouTube

Web Which One Of The Following Is True About Dividend Growth Patterns?

Three Special Case Patterns Of Dividend Growth Discussed In The Text Include:

Constant Growth, Supernormal Growth, And Zero Growth.

The Value Of A Firm Is The Function Of Its ______ Rate And Its _______ Rate.

Related Post: